Bad News On Caterpillar Going Into a Friday.

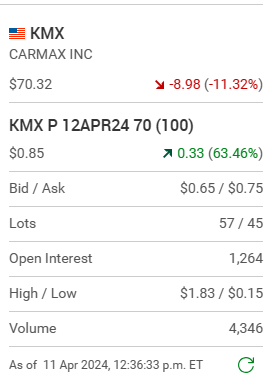

Here is how the stock traded on a Thursday.There was nothing unusual about the day. I am suprised they would dump this news on the market going into a Friday trading session. It messes up option traders. Doing this type of an announcement on a Tuesday prior to the markets opening would be a less disruptive day to do this. Here is the news. In a way this wasn't totally unexpected news. As they said, there were several other recent updates on this issue. Auto companies in their recent quarterly reports were harping on this issue. Look at how it dropped in price in the after market trading. Now here is how one series of Puts closed the day. Look at how this news totally caught the markets by suprise. The secrecy of this news is a credit to Caterpillar. If Caterpillar had this news are Deere Call holders going to get worried? Here is what happened on Friday morning. Now Deere which is now also trying to shake off this bad news. These two stocks tend to trade in similiar ways. He...

Comments