A Look At "The Bids And Asks" On Two Different Series Of Put Options That Expire In A Few Hours

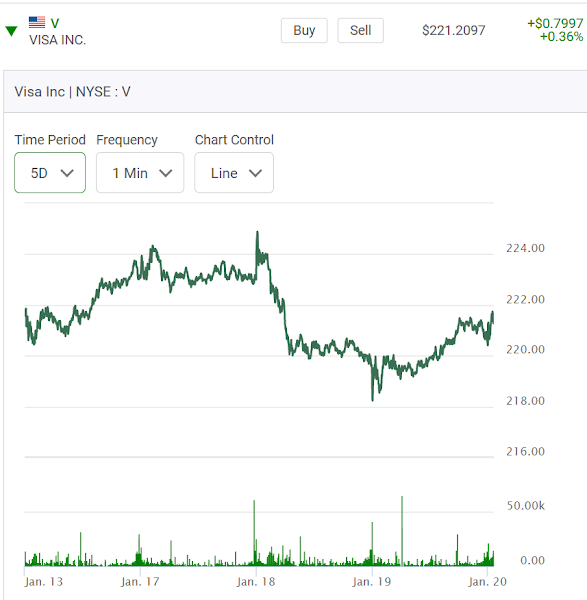

On July 3th the markets were closing at 1:00 p.m. with July 4th also being a holiday. Many traders were disconnected from the markets. It is holiday time. Let's look at these two different option series. 1) Boeing. It jumped up in price over $4.00 in early market trading. Boeing does that sometimes on Fridays. It's 10:15 a.m. and here are the slightly "out-of-the-money" $215.00 series of Puts which are just over $1.00 "out-of-the-money". The stock is at $216.21. These Puts expire in less than three hours. If Boeing started to give back some of it's gains these Puts could be worth big money.The stock is at $216.21 and the striking price of $215.00 isn't really all that far away. Look at how cheap these Puts have suddenly become. What ended up happening? Here is a summary of how Boeing end up trading on the day. Boeing never ended up selling off to below the $215.00 price range. The 215 Puts ended up expiring worthless. *** There was other ac...