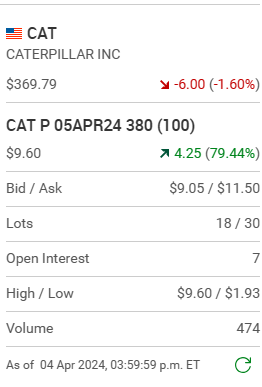

What a crazy one day trading session for Caterpillar.

Notice only seven "open interest" contracts at the end of the days trading session. Seven. That's not a very big number. The bandits who bought Puts have taken their money and have run away. Tomorrow this unexpected dip will be history. If thousands of option traders are watching Caterpillar why did so few traders anticipate this afternoon sell off? Why didn't more Put traders jump is as the stock started to dip? I missed it. I was caught up watching Boeing on an hour to hour basis which also a stock that can also make bold moves. Notice also all the action started in the afternoon. Now here is it's five day chart.

Going forward into Friday it's a day of "stay-away" after the action like this. Stay way that is unless you were lucky enough to make money on the downside and you want to throw some of your winnings into catching it shoot back up again. Two closing comments. Caterpillar was up $10.00 on the previous day on no apparent news. When the D.J.I. which is an index of a relatively few number of stocks drops over 500 points in one day and when Caterpillar stoically trades sideways for the first half of the day one might expect it to feel some selling pressure. The second point. So many people think day trading is best an exercise for computer wizards or Ai programs. Not so. Option trading can be a work from home job which ends at 4:00 p.m. each workday with no weekend work required except reading. The platform you use to trade on is open to all and there are no association fees required to be part of the system. Earning seasons can be exhilarating to navigate with quick rewards offered. Its best also to take off most of the summer and take extra time off during the holiday seasons when the trading action often doesn't seem to make much sense. #### Friday morning. The morning after. Option players bold enough to take a stab at a Friday morning rebound were handsomely rewarded.

Now the end of the day.

Call me chicken for not wanting to consider playing Friday's action. It's amazing that so few traders caught this action. (Caterpillar closed Thursday at $373.36 and opened at $372.50 on Friday morning so there wasn't a gap opening). In this instance, this was the best trading opportunity of the week, but one extremely difficult to rationalize. When we see action like this the relevancy of "one-week-out" options is questionable.

Comments