Featured

CarMax Puts?

- Get link

- X

- Other Apps

Here is the number. Call in to listen to their just released quarterly report. You won't have to talk to anyone. It is 800-839-1247. In about five days this link will disappear. Please listen to it. I listened to all of it once and to the first half of it two times. What I learned is that their retail car sales on the quarter compared to the same quarter a year were up 6%. They purchased 336.000 vehicles from the public, up 7% and 48.000 from dealers up 38%. Their average retail sale price was $26,100, down $400.00 per vehicle from last year. They doubled their share buy back program. AI technologies are now helping them operate more efficiently. Everything seems positive. But wait, we are talking about the used car business and what could happen if consumer confidence suddenly starts to wain? Look at it's three year chart. It now sees to be hitting a rough patch.

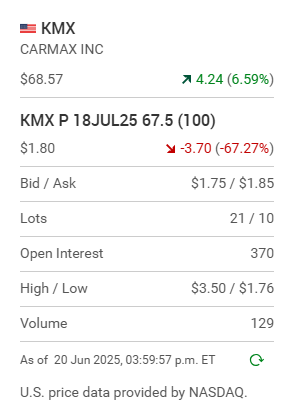

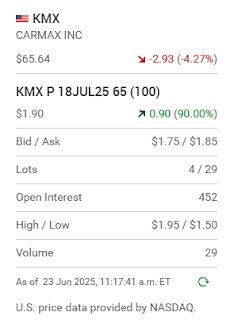

Now a one month chart. All of this talk about tariffs and what level of tariffs will be imposed on new vehicle sales is adding to the confusion. Could tariffs help the used car industry? CarMax in it's earnings release seems to sidestep the issue of tariffs. Hundreds of YouTube videos focused on the used car market talk of the troubles ahead for the used car industry. People are having trouble making their car payments.Now this. CarMax options are staggered to be in one month cycles Here is a look at one series of Call and Put options which are set to expire on July 18th. Each option series is staggered in $2.50. increments. First the Puts which had a massive decline in value last Friday as the stock popped upwards on the results of their earning report. Remember there is still about one month of trading life still left in these contracts so buying either of these two options becomes kind of a waiting game. First the 67.5 series of Puts.

Now the Calls.

These Calls have just jumped from being "out-the-money" to "in-the-money".

So the question now is will CarMax hit $65.00 or $70.00 first. You decide. Having one month of trading life left in both of these options makes this a fair game to play.. Might there now be a slight pull back now it' earning have come out? I think so. It's a tough call to make. Fast money trades Carvana Company options instead. It's trading patterns are wild. Here is how their one day Call options jumped on the day last Friday.

One would of had to pick 10.00 a.m. as the time to get in to capitalize on these riches.When you can see action like this happening in "one-day" to expiring options it's difficult to get excited about thirty day options. Both however have their time and place in the life of an option trader.

Comments