Let's look at it's five day chart of Costco. I talked about how Costco spiked on an earning's report last Friday. Why would a food distribution stock do so well in such uncertain times?

This five day chart is as of 3:30 p.m. on Wednesday. It's kind of going sideways on the day. Sideway moving stocks take the air out of short-term option pricings. Here are the 1040 Puts which are fifteen dollars "out-of-the-money". Why bet on a stock dropping that much in two trading sessions? One reason is that a drop of half of that amount will move the needle on these $3.29 Puts. Options on stocks that trade in the $1,000 can take some strange twists and turns.

But why Puts and not Calls? The main reason is that Costco jumped last week on an earnings report which was not necessarily all that impressive. Is Costco about to now take it on the chin? Sometimes it takes a week or two for stocks to come off their "earning-report-highs". Then there is the new issue of Musk saying today "I just can't stand it anymore". That kind of statement does not bring confidence into the markets. Tesla is crashing on the week.

Now this. The street tends to think that Costco is going to go up.

It's all really just a guess. I wouldn't want to be in a Costco option position overnight on one week options that expire the next day. That's the position that this series of options will find themselves in at the end of the tomorrow's trading session. One contract will only cost a couple hundred of dollars. Holding these contracts overnight is dangerous.

Now this.

Here is a premarket article on Costco and here is how the market reacted. It seems to be impacting the markets.

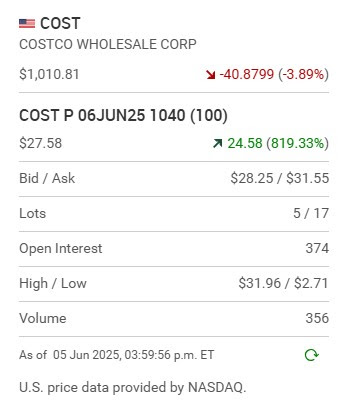

Now the Puts. Look at these two quotes and see the bids and asks increasing.

Can you see the bid and ask are higher that the most recent sale price? If you look below you can that this is happening again.

A jump in price from $8.00 to $14.00 in four minutes! That doesn't happen very often. Remember I said some option players don't like holding option positions overnight? This is a good example of option players jumping in after the bad news and still catching some of the action. With Costco you can sometimes do this however with many other stocks you can't. Costco can't drop forever. Getting out now just before the end of the first hour of trading would be a wise but not necessarily the most profitable way to go. Here they are trading at 10:24 a.m.

Now the end of the day!

What the heck are we now looking at? We are looking at a further market decline and the hours tick by. Can you see how powerful Put option can be! Yet then again, it is not everyday Costco drops this much.

Now for an observation? What's all this talk we hear about "artificial intelligence" making market trades? We all know that Costco, like many other stocks has a history of shooting upwards or downwards in price quickly during times of earning report releases. Why can't artificially induced buying and selling programs kick in to catch these short term directional moves? Isn't the name of the game to recognize tradable option situations? If I was able to hone in on this tradeable event happening why couldn't A.I. ? That I don't understand.

Comments