Trying to understand why oil prices fluctuate is a job in itself. Look at how Exxon Mobile is trading. Here is your chance to play with the big boys in some of the most exciting option markets that we have had in a long time. Look at how Exxon has traded in the last 30 days. These are big swings in a relatively short period of time. That's what helps in keeping the interest in playing options on Exxon so high.

Now this. A five day chart on the morning on June 9th, a Monday. Look at the spike it had. Remember in my last blog I showed a spike in Deere only to watch a sell off two days later

Now another five day chart, this time Exxon on Tuesday June 10th around 2:45 .p.m.

Look at how the stock is stepping up. Could it drop down to $104.50? The chart shows that it could. Or it could keep jumping up. Oil prices have being depressed as of late. I generally like Puts more than I like Calls. Stocks sometimes drop quicker than they go up. Now this, a look at yesterday's action. We are now looking at the 105 Puts.

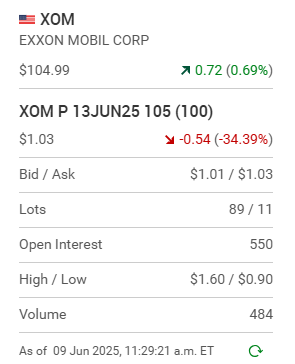

This shows how the 105 Puts which expire this Friday were trading at 11:29:21 a.m. yesterday morning. Now lets look at were they are now trading at 2:58 p.m. today which is a Tuesday..

Oh brothers. They crashed in price as the stock continues to go up. Now they are so far "out-of-the-money" that they will probably never come back. What was once $1.03 is now only worth $.31. What this points out is that if you get caught going the wrong way these options will kill you. Now this. It's Tuesday at 3:08 p.m. We have to change our focus and shift the striking price to a higher series because the stock continues to go up. Here is how the 108 series Puts which expire once again at the end of the week are trading and here is Exxon's one day chart going into the last hour of trading.

Now here are the Puts at 2:58 p.m.

To help in adding more perspective here is it's now current five day chart.

Where do to think this stock will be in three trading sessions? If the stock dips down to let's say $104.00 these $.90 Puts will jump to $3.00. Even at $105.00 they would still be worth more than double what you paid for them. What I find so enticing in this instance is the volatility of the play. The danger of coarse is that the stock could keep jumping up day after day. Now a 3:48 p.m. update on the 107 Puts. Exxon continues to go up in price and the Puts are only now worth $.74. The volume of trading in this series of Puts is very low. Players playing the upside have more than doubled or quadrupled their monies in the last two trading sessions. That's the power of one week options when the stock goes from $102.00 to $106.00. Following that printout is a look at how the 107 series of Puts closed the day.

Can you see how they moved up slightly? That in a way was a defensive uptick reflecting the chance of a lower trading price in the morning. Let's see what happens next. Now a five day chart goin into the premarket on Wednesday morning. You can see in the premarket that the stock is opening upwards. You can see the "bid" and "ask" just below. What a strong chart pattern.

Going into the Wednesday morning trading session I want to show you the ratio of outstanding Calls to Puts on this one series of options. Remember there are multiple series of Call and Put options.

8,441 Calls to 534 Puts! Now this and it's only a small part of the story. Let's jump ahead to take a look at the action at 1:33 p.m. We now see that the Puts are wasting away.

Yet think about this. These Puts closed at $.78 and we then saw them trading at $.76 at 9:33a.m. Sometime after that they hit a high of $1.05 as Deere sputtered on the opening. Here is it's one day chart as of 2:00 p.m. .

So basically it was at 11:11a.m. you could have got out of options you bought at 3:48 p.m. on the previous day for $.74. Out at $1.05 if you times it perfectly. It's not much of a trade but it is a trade that anticipated some weakness on this morning's opening after a strong close. Look at the strength coming back into the stock around 2:02 p.m. The Put idea is not the correct focus to have.

Here is the 107 series of Puts on the close.

Not fun if you own them. Now look at how these two series of Calls traded on the day. The low of the day on these Calls was once again around 11:11a.m.

Now these ones which were one option series higher .Look at how they traded down to $.03 cents!

So where does all this leave us at the end of the day, a Wednesday? Some traders were buying the 109 Puts on the close in the hopes of a slight decline on the opening. Others are riding the Calls that they bought today. Here is how the $109.00 Puts closed the day.

Now the Calls.

What a run upwards the stock has had so far this week. Once again the DJIA moved only one point on the day. It's due to make a big move up or down soon.

Now it's five day chart.

Now the action going into Friday, the last day when this weeks option series expires. Here now is a five day Exxon chart.

Now this news which will change the game.

Oil up 7.7%. This news is devastating to anyone trying to play Puts. Here is how a slightly "out-of-the- money" Call looks going into the opening. What a day it is going to be for these Call holders. To be continued.

Now the opening and closing Friday reading on this series of Calls. They closed Thursday at $0.51 and opened at $1.01 and went as high as $3.35. What an amazing week for Exxon . Sorry for making this blog so difficult to read. This was a wild ride.

Comments