Featured

The "Sliding Door" Syndrome - Hertz

- Get link

- X

- Other Apps

This might be a difficult blog to read but it might open your eyes to an entire basket of stocks you never thought to consider playing options on. That said, try and get through this read. Open the sliding door and guess what might happen? Suddenly you will get a feel of which way the winds are blowing? Stocks in the used auto car industry got dumped on last week on tariffs news. Trump came out and said he might raise the tariffs on new cars to more than 25%. He also did something to mess up "the wind and solar energy companies" to the delight of big oil. The stock First Solar is getting crushed.

1) Carvana Company. It sold off over $21.00 dollars on the day last Friday. They have a reputation for having share manipulations with a long history of insider trading. The stock has a short interest of 5.3% . It didn't help much that the DJIA was down over 700 points on Friday.

Now here is a look at the 65 series of Calls on this stock that expire this coming Friday. Once again on Friday morning at 9:00 a.m. their earnings report comes out. These options will be interesting to watch all week. It's chart is ugly . The entire sector is difficult to play.3) Avis was off on the week also.

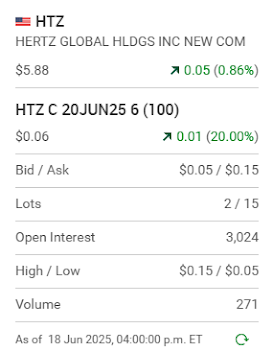

Might it be that all of these companies in this space are a touch oversold? Will new car sales start to falter with rising steel prices and will that cause used cars to continue to be able to command premium pricings? Tracking the one day movements on any of these stocks could be a full time job..4) Remember how I sometimes talk about options on stocks that trade in the five and ten dollar range? Look at these Call options that trade for $.20 cents (or $20.00 a contract) that expire at the end of this week. This time the company is Hertz and it's stock is trading at $5.87. I will focus on this option series for the rest of the week . The stock did trade last week up to over $6.40 and that is the one reason I find this series of Calls somewhat somewhat interesting. The chart however looks like the stock still wants to go lower. What do the Put holders know that I don't? The volume in the Puts is high which kind of scares me.

These are $.20 cent options ($20.00) a contract.

What do you see? A low of $.10 near the opening and a high of $.23. The stock only gained. $.05 cents on the day. That's nothing.. What are the Puts doing?

What do you see? A low of $.10 near the opening and a high of $.23. The stock only gained. $.05 cents on the day. That's nothing.. What are the Puts doing?They lost 45% percent of their value on only a $.05 upward move on the stock.

It's up over $10.00.

#3) Avis . Stocks in the $120.00 range have nicer swings that stocks that trade for half this price. Like Carvana these were the ones to be in. Let's see what happens tomorrow.#4) Hertz Global. I added the word Global which I previously omitted. Some of these stocks have a global presence. Here is how the Calls we are watching closed on Wednesday. They are a bit wobbly.Can novice option players dabble in these kind of options? Yes and no. It's easier I think to get into the grove of following stocks like Tesla, Caterpillar. Boeing and Walmart which are under the scrutiny of a much larger audience. To be continued.

#3) Avis . Stocks in the $120.00 range have nicer swings that stocks that trade for half this price. Like Carvana these were the ones to be in. Let's see what happens tomorrow.#4) Hertz Global. I added the word Global which I previously omitted. Some of these stocks have a global presence. Here is how the Calls we are watching closed on Wednesday. They are a bit wobbly.Can novice option players dabble in these kind of options? Yes and no. It's easier I think to get into the grove of following stocks like Tesla, Caterpillar. Boeing and Walmart which are under the scrutiny of a much larger audience. To be continued.

Comments