The markets are flat this morning, a Tuesday morning. Might things in the market start to change by Friday? Of coarse they will. Boeing as of late keeps trading down even though the demand for new planes outstripes the supply. Boeing keeps the world mobile and nothing is going to change that in the foreseeable future. It's stock should be going full speed ahead but its not.

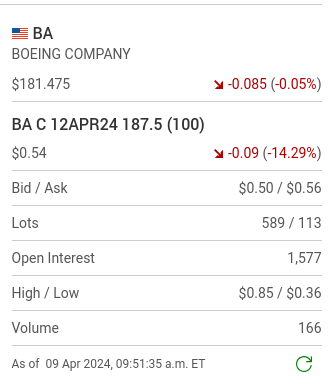

Let's look at way "out-of-the-money" Calls on Boeing which expire this Friday.That's a stupid thing to be looking at because the probability of a payback is quite low. I have picked the 187.50 series of Calls which is like $4.00 or so "out-of-the money"and which expires this Friday.

Now here they are ten minutes later with volume increasing.

One hundred and eighteen were opened up in a ten minute period of time and the stock as the stock has sold off forty seven cents. Why am I trying to hone in on such a thin slice of market activity? Might it be best to take a position in something when the markets seem to be in a state of pause waiting for a directional move? Wouldn't it make more sense to look at option series closer to being in the money? Probably. Yet it's only Tuesday and a sharp uptick would do wonders for an option series like this. Now look at this.

Boeing now seems to be holding it's own in the first hour of trading and the Call options are relatively flat. Yet the options are best to consider when they are at the top or bottom of one of these breakout ranges. In this pattern there is no sense of urgency to get in.

Now an 11:00 a.m. update.

And now an 11:15 a.m. update.

Boeing seems to be holding it's own however with the five day chart moving down and the D.J.I. moving down its difficult to get excited about an upwards move.

Now the five day chart.

Now here is some option trickery coming into Boeing's option pricings. Boeing stock dives and the Call option premiums do reflect the true magnitude of this sell off.

What's this all about? What is happening now? Shouldn't the Call prices be going down quicker than they are. Bid $.36 ask $.53. That's a huge spread which suddenly puts traders at a huge disadvantage. Yet I can understand why. It is afterall a time period of intensive volatility and why should the system be set up to allow short term traders to make buckets of money everytime one of these irregularties arise? Now this.The stock is now at $178.06.

Finally there was some panic and an opportunity at the height of the panic. At some point in time the asking price must have dropped down to .17 cents! Look at how wide apart the bid and ask have suddenly become. This makes them difficult to try purchase at the price that you want to pay. Now here is how things were trading at 12:45 p.m.

....

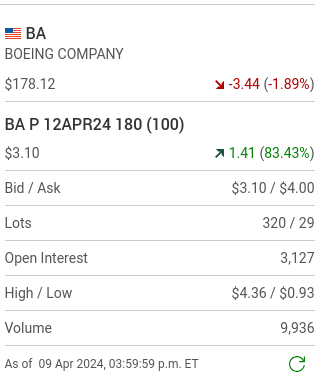

So what ended up happening on the day?

As a reader do you feel exhausted reading all of this? What is there to learn? 1) A stock in a downward trend is exactly that. It should be respected. Looking for a reveral can be a fool's game. 2) Short term option trading can feel at times to be long term trading. In all fairness, I respect the trading patterns of the stock Boeing and the predictability of how the stock moves. Now a look at the 180 Puts on the day and look at the volumes of option trading.

That's where the action was. ** A next day April 10th update. Boeing is down again.

Comments