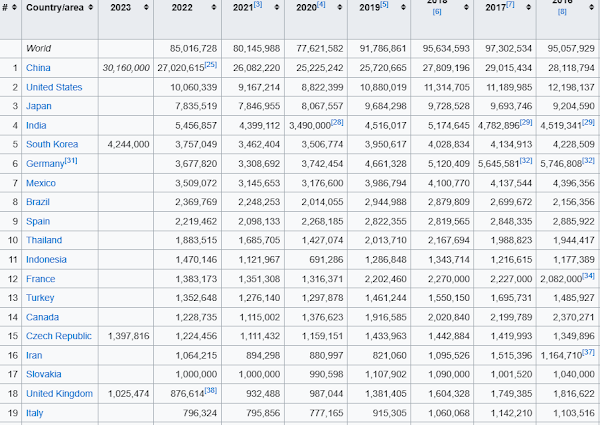

Here are the top 19 countries in the world that produce cars.

Here are tho top 10 Chinese EV makers.

The chart is wrong! It's missing Telsa.

Telsa and BYD are fighting for the number #1 and #2 spot. BYD now has their own special news happening.

Also noted is that Canadian production is off by about half it once was in less than ten years. Let's now talk about Nio. Nio is number three on this list and regularly one of the most actively traded EV stocks on the NYSE. It also has the fastest EV racing car in the world. Here is it's one year chart.

Options on stocks in the five dollar range can delight if you catch the right direction. Nio has hit a rough patch as of late. Back in January 2021 this stock was up to over $61.00 dollars per share and production has ramped futher up since then. It's expanding it's sales into Europe. It could take off again if and when production numbers go up. It's not bad to be #3. Here is yet another Chinese EV play called Li Auto. It's ranked as being #5 on the top ten list and has plans to produce 800,000 units next year. Remember everything now is focused on units built. There is more to the story. First, here is it's five day chart!

Now look at yet another stock called VFS. It has big dreams which seem to be coming closer to fruition.It is a Vietnamese EV company now setting up a plant in South Carolina and they are currently selling cars in North America and elsewhere.

Look below at how it popped when it first got listed on North American exchange. There is a story behind that - it came out as a"Spac" and the float they released was very small of their total outstanding shares. The stock has gone sideways for a long time since released.

They potential have a small "box-like" truck as part of their portfolio and also make E bikes. They actually make a lot of E bikes. At some point in time going forward the laws in the U.S. may change, making rebates on the purchase of EV bikes the new norm. Now here is the lastest part of the "VFE" story.

Notice Lucid and Rivian were lumped together in the same camp based of unit production expectations.That theme guiding prices movements of EV stocks is now prevalent. Polstar now has this news. It is cutting back it's exposure to this space.

It's good is that they have just got additional funding.

Then there is Fisker falling below the $1.00 price range which has set off regulatory alarms. That's something they will have to figure out. Like it or not,the world is flush with money that is ready to float the boat in this new evolution. It's going to be an exciting ride for many investors.

Comments