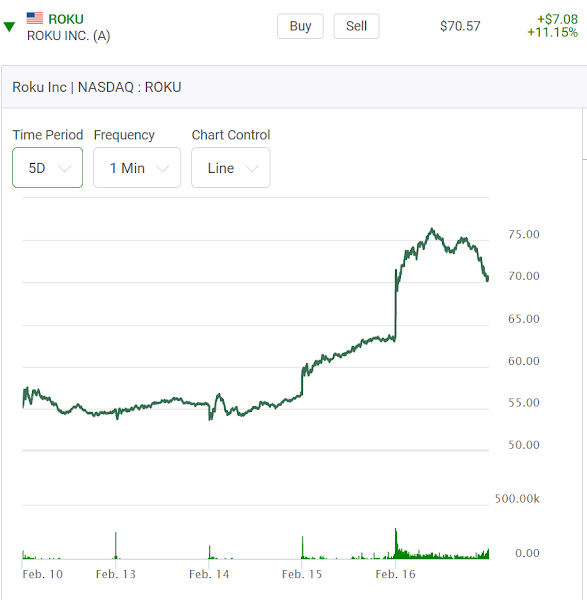

Let's start with an observation. When I see this kind of a chart formation, a one day spike upwards it makes me cringe. I don't like it and I instinctively want to play it on the downside. Do you think this is a stupid bet to be making? Not really if you believed the fresh enthusiasm was an overkill? I did.

Roku jumped on Thursday on a "so-so" earnings, well really a "lost" report. The numbers were not that great.

Disney and Netflix and many other stocks in this space are prone to jump up and down quickly. It's a constant battle of winning or losing subscribers. Analysis watch the action closely. When stocks jump up like this, there is a tendency to see a second wave of buying come in the following day. In spite of that assumption here is what I decided to do. I wanted "in on the downside" and the vehicle I chose was a Put option that would be expiring the next day. That's aggresive.

I bought one Put, the 74 series of Puts at 10:34 a.m. and was quickly in an offside situation. Stuff happens. Suddenly your sitting on top of a whale (in this case the whale was Roku) hoping for it to go back under. Might the stock go down for new reasons just being realized by investors? The earning's report wasn't that good. Once again your waiting and waiting and this waiting feeling is not fun. We are talking waiting a couple of hours. Off by like 30% on my investment. At times like this you ask yourself why did you ever buy it? When might that cliff-hanging Put option you bought start to kick in? I caught a touch of downside action later during the mid afternoon and got out of the Put position at 3:15 p.m. It wasn't as much of a gain, well it wasn't really a gain at all. I was just happy to get my money back. Closing out of this position became a reality as the "risk-reward" ratio didn't make sense to stay in. I didn't want the risk of holding this Put option on this stock going into a Friday. It was pushing things to hard.

Here is how Roku traded the following day. It came off in price. Had I held on to it going into the Friday and got out at the right time I would have done much better. In this case my mistake was in getting into this position before the stock finished spiking upwards. Timing is everything. Here is it's one and five day chart.

It's a tough game to play. Now look at how this stock was trading two days later. I should have bought a Put which would be expiring at the end of the following week.

*** a Feb 23th update. Look at this chart. It's a different company.

This company is a chip maker. Earnings in this field are related to getting a product out the door. In contrast, Roku is in a different kind of space with more speculation about future income streams. Let's watch to so see if this chart formation sells off.

Now notice that days later it is still hanging tough. That's the difference I am talking about.

Comments