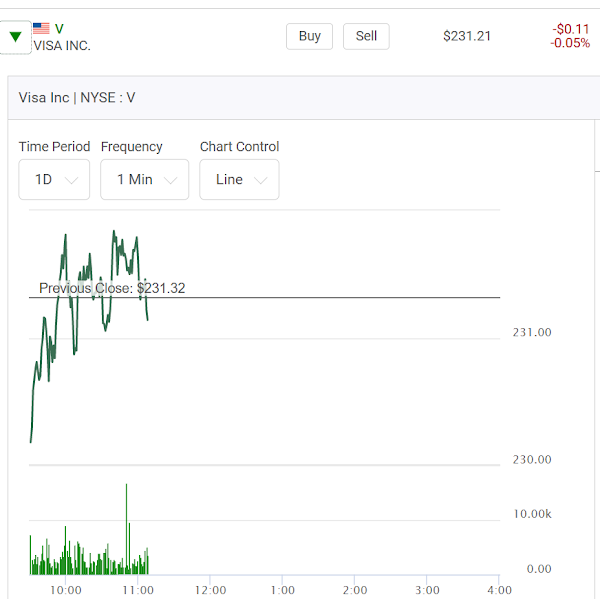

In option trading traders get a fair deal on wednesdays if you can capture the right directional move. Stocks can pivot on the day and pivot on a dime. Case in point is Visa. First, look at how it was range bound on the opening. Yet range bound enough to play it. Look at the dips it had in the first ninety minutes of trading.

Here is what I did. I played a dip down. In at 10:55 a.m.and out at 11:08 a.m. That's thirteen minutes. Buy five Put contracts at $100.00 and out at $127.00

Points to consider. 1) Market swings like this only seem to happen in morning markets and not afternoon markets. 2) Wednesdays are the best day of the week to look for this action on options that expire two days away. It's like the tippng point of the week and the smallest directional move causes the options to reacte.

Now here is how the stock closed the day.

Lets now look at the action going into Thursday. Here is how the stock looks in premarkets bids at 5:38 a.m.

Watch the 230 Put series as the changes on the opening.

So here is what I did. I looked to first see how high the stock closed in the last couple of days.

I thought about a reversal and bought "out-of-the-money" Puts that expire in a couple of days. I bought seven contracts in two orders spaced nine minutes and then thirteen minutes apart. So for twenty two minutes I was playing the stock the wrong way.So what happened next? I will tell you. I waited and watched the screen thinking that this could be a ten minute trade. The first two sets of contracts were bought at (9:40 a.m. and 9:49 a.m.) Then at 10:02 a.m. I bought four more contracts.

The final buy ticket was a bit cheaper.

Then I decided to get out. There was a risk the stock could bump up even higher and if I took a profit there would always be something more comfortable to play. I sold out.

Eleven contracts at $80.00 each at 10:20 a.m. I made a little. Had I waited another ten minutes then were up another 20%. Here is how the stock traded at the end of the day.

After you sell something you don't look back and say "what if".

Comments