Will Walmart Go Up In The Next Two Days And Will Avis Budget Come Down In Price In The Next Two Days? A Whimsical Look At Two Day Option Trading.

What the heck do I know? I am better at picking one day price swings. See my last few blogs. It's Wednesday after the close of the markets. Look at the five day chart on Walmart.

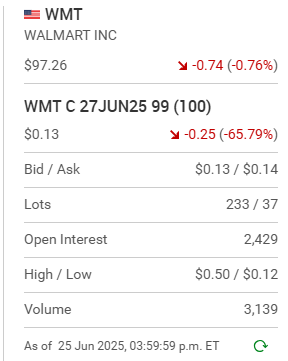

There could be a lot on the line if you play the Calls for it to go back up in the next two days. Here are three series of calls to watch. Some of them are very affordable to purchase.Now look at it's one day chart to get a deeper dive as to how it trades. Does it look like it wants to curl upwards?Now Avis Budget.. This stock bugs me because it has gone up so fast on so little news. Here is it's thirty and five day charts. First the thirty day chart.

Is it starting to waiver or is it my imagination? Here is the only real news I can dig up on it.If it's going to sell off it would seem to me Thursday and Fridays would be a good day to make it happen. Now look at how these two series of Puts are trading. Calling the tops is never an exacting science.

Is all of this downside action wishful thinking? The Puts are super expensive and so few traders are trading them. Why try and fight a strong stock? If you don't really know the entire story it's better just to stay away. I now want everyone to consider this one reality.. In the illustration of one Call option series below can you see how many open interest contracts there are outstanding in a lower, "in-the-money" position? There are thousands. What is going to happen when the cookie starts to crumble? Call option holders might be bailing on them as quickly as the can. It's going to be interesting to find out how it all plays out.. To be continued.

Comments