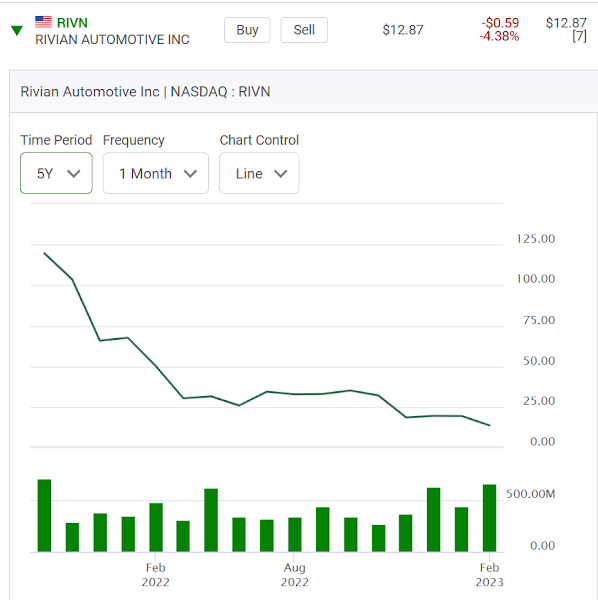

So Rivian shares have dropped. What a dream machine they have built.

But wait, they also are hooked in with Amazon and they are providing them with electric trucks.

Now look at this. Their number of employees.

How would you get to this level of employees if you were not onto something good? Look at how they have more employees than many of their piers. Yet there is a risk to the stock's price if they were to suddenly announce that they are laying off a thousand or so

workers. Amazon is using a number of their delivery trucks and it's obviously a learning curve for both of them. How well are they built and will they prove to be problem free? Rivian still has to prove the quality is there. Then there is also the issue that G.M. has leaped ahead of them and is busy shipping out these electric trucks from Canada with a 250 mile range .G.M. has deep pockets and their factory for exclusively this product is up and fully operational.

On a different note the truck company Lordstown is having production issues and will need more money. Read the number they have reported for production levels. So many of these electric vehicle companies are having quality control and part issues. Read this. ">

More now about the concerns that Rivian is facing. Money issues and here is the thing. When they go back to the well to ask for more money (they will need to) new shares will be issued which causes the stock to drop in price. It takes huge amounts of money to get these undertakings going. Look at "Last Mile Solutions". It recently went under. Their books got messy. One stock called "Sono" I watch, that had Whoopi Goldberg's approval last year recently chopped their solar electric car project they were working on because there was no new money (or not enough) to support it. You only can make money when you have actual sales, not just orders.

One more observation. Sometimes companies, just at the point in time of starting to make their shareholders feel happy because their sales are upticking start losing even more money even though they are starting to produce more vehicles. Why? Well production costs go up and vehicles nearly finished sometimes end up sitting around in inventory waiting for final pieces to show up. That plus Telsa is dropping their prices on some models. Will that become an unwelcomed trend? Case in point is another EV company I have mentioned before. The Electric Bus Company which is a Canadian operation now also setting up shop in the United States. It has a tremendous backlog of orders. Here is it's chart. It's ugly.

Look at how their output jumped. Yet here is the point. If they produce more they might lose more. That doesn't seem to make sense. Lucid might also have that problem when their production lines start to speed up. As shown above they have 3,900 employees and their production levels are starting to ramp up and they have orders. Might this be one to watch?

You can only make money when production numbers really start to kick in. Tesla over the next few months is the only stock to really try and play until all this downward sentiment goes away.** Rivian once traded at $119.00 per share.

On a similiar note please read my Jan 15th blog on Lighting E Motors. It also is hoping to be an electric truck vehicle turnaround story.

** a new rumour March 20th

Comments