Caterpillar Calls with one day go and Caterpillar Puts with one day to go. Boeing Calls and Puts with one day to go. Both stocks have had massive unbated run ups in the last five days trading sessions.

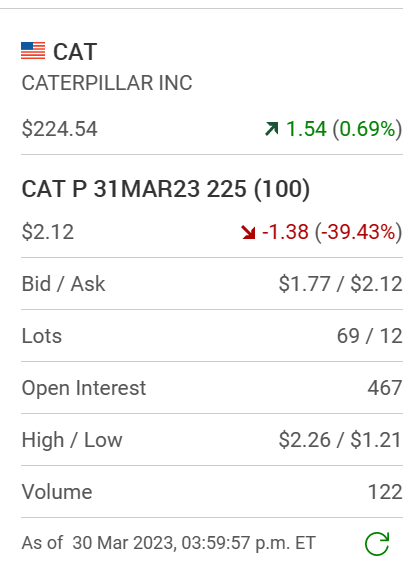

Now lets look at the Caterpillar Call and Puts options at Thursday's close going into Friday. These are the Calls and Puts that expire tomorrow. The premiums on these option contracts are at slightly elevated levels given the volatility in the trading of these options over the last few trading sessions. Will this be another day, like most in the recent past where these stocks gain one to three dollars? This is to rich a game for me to play. It was a good game to be in during the last few days. Let's start with the Caterpillar Calls.

The premiums on the Cat 225 Calls don't make sense. At $1.60 per contract thay are .46 cents "out-of-the-money" meaning the stock would have to jump to $227.04 just to break even. That's crazy expensive. The Puts also are no bargain.

This time the 225.00 Puts are "in-the-money" .46 cents so getting into a Put option postion would cost $212.00 dollars and the stock would have to fall to $222.88 just to break even. The Boeing story is equally prohibitive to play but so much more exciting. It had a huge run up in price today on news of more orders. Boeing is know to sometimes jump ten dollars or more on a good day. Here is some of this good news.

Look at the action in the Boeing Calls today and look how expensive they are to buy into.

But wait, these Calls are already "in-the-money" so there is a play here if the stock jumps on the opening. Here also is the closing Put price.

Boeing tends to have more news releases than Caterpillar and it's options tend to be more widely traded. The bottom line is that fighting a rising stock by playing the downsize is most usually a losing battle. It will be intersting to see how all of this plays out tomorrow. My take on all of this is that there are easlier battles to fight. Let's see what tomorrow brings. There might be a morning pop.

Here is what happened. Here are the markets at 9:46 a.m. on Friday morning.

Here is what Caterpillar is doing. This series of Calls closed at $1.60 so there was a bit of a bounce.

Now how did Boeing do on the opening? Remember that the interest in these Calls were so much greater.

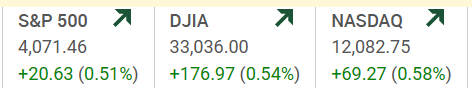

They are trading at $4.00 when they closed at $1.99 at yesterday's close. That's a double in the first hour of trading. That's the power of options with one day to go. Who would be playing these? The same option trader's who made money on Boeing and Caterpillar Calls all week. Would smart money take their profits for the day and go out and buy lobsters? Maybe. Look now at how these two positions closed out the day. Yet first, here is how the markets closed. It closed up a big chunk. It was the end of the first quarter.

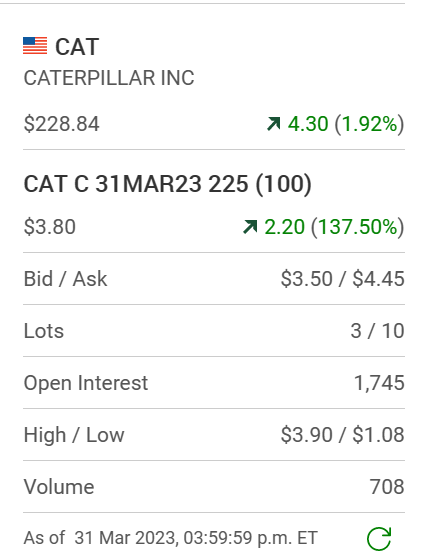

Now here is how the Caterpillar Calls closed.

Not bad from a previous close of $160.00 . Boeing in contrast kind of sputtered in the afternoon after a morning surge. Part of the reason was that yesterday's good news is now old news.

It's not every Friday that the D.J.I rallies over 400 points. Would you have the guts to be playing in these markets? One final note. Watch how these "out-of-the-money" Caterpillar Call options traded on the day.

Comments