Electric motorcycles. It's a new field. Companies in India and China are now making them. So Harley Davidson has decided to spin off a new company to start producing them. It's wise to place that operation in a new name. New money comes just on the strenght of the Harley name and the company gets to wander off in a new direction to tinker on something new. It's called "LiveWire Group". Symbol "LVWR". But wait, lets be blunt. There are start up cost and learning curves. They are taking a go slow approach keeping guidance numbers low. Model offerinsg down the road a few years from now will probably be more disireable. It is doubtful that the early models will prove to be collectable. Learning curves will be for everyone, since if you are out on the street you may not hear one pulling up next to you. A motorcycle with no noise. Some bikers would find this new reality strange. Would they be as much fun to operate if they are silent? Read the reviews online. Yes there are concerns about the availabity of charging stations. If Harley Davidson is spending money on this new venture when will they start to see a return on their investment? It's enviable you will lose money until volumes of production are ramped up. So one of the questions now is why are investors willing to go along for the ride? Are thay "overly forward thinking"?

Let's look at how this new stock is trading. Here is it's chart.

Is that chart scary? Good question. If you look at Fiskers, Workhorses and Polestars three year stock charts, all being electric vehicle plays you will see similiar chart patterns.

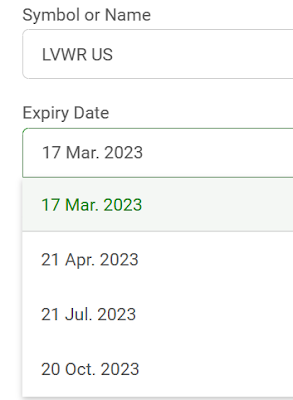

Issues are being dealt with. Supply chain issues, manufacturing issues, building material cost issues, there are so many variables in play. Options on these stocks offer little wiggle room. Trying to play them for one or two week trades is impossible. Here is a look at the cycles they trade. October is as far out as you can play them.

There is no volume in these options and the bid and ask spreads are crazy far apart. Here are two examples.

Does LiveWire offer any guidance? Not much.

Now think about this. In China every fifth household has a motorcycle and in the month of Jan. 2022 China sold 1.45 million motorcycles. LiveWire is talking 750-2,000 units total to be built in total 2023. I think LiveWire / Harley Davidson is purposely puttering around in low gear waiting for others to build out more charging stations. In a few years time this stock might have potential yet in the short term it is just putting in time. What do I know?

Comments