Rivian and V.W. Partnership News and Trading Rivian Call Options Between 3:00 P.M. and 4:00 P.M. On The Day Of That News

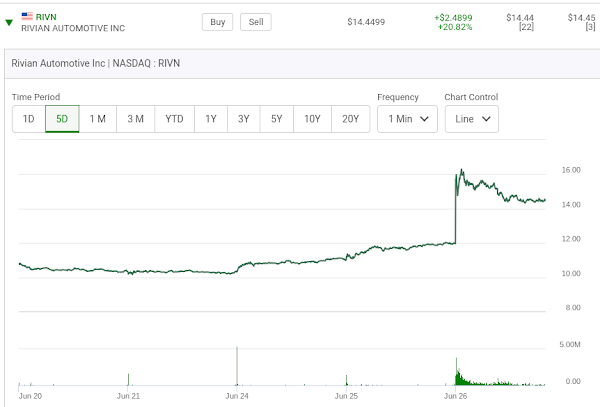

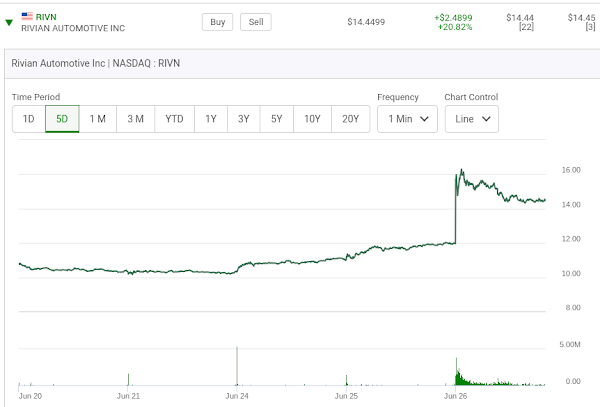

There was fresh news that we will tell you about shortly and this is how the 14.5 series of Calls on Rivian were trading at 3:11 p.m. today, a Wednesday. This is mid week news and these particular Calls will be expiring in two trading sessions. Why try to play something that short term when you are late to this party? Only insiders selling would be profiting on this news. Unfortunately that's just the way the system works.

Now this. You decide. I think it has the legs to go higher.

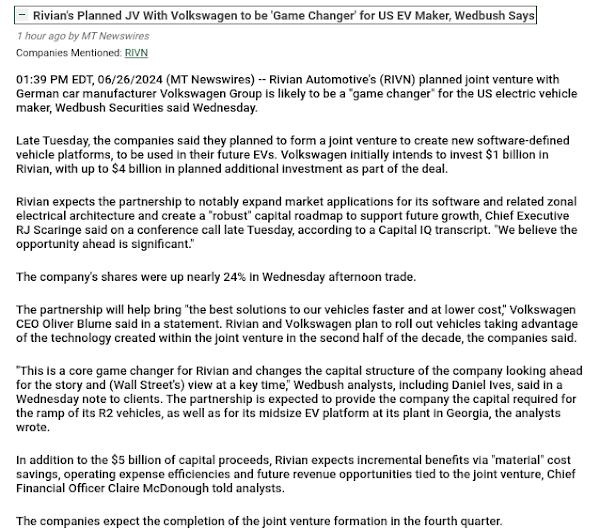

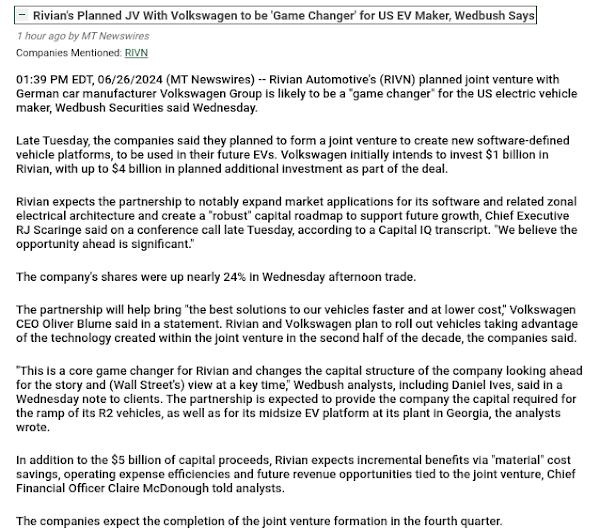

Now the news which caused the stock to jump.

Notice that Rivian cracked the $16.00 range in it's early morning trading only then to sell off to the $14.36 range at 3::11 p.m. Traders jumping into this morning frenzy using short term Call options as a vehicle would have of overpaid and are stuck now in a dangerous situation. This no longer is a good short term story. Friday is only two days away. Yet there is a chance that the last hour of today's trading might see a further upside? Why? It has to do with the fact that the volume of trading during the last thirty minutes of an given trading session spikes upwards. As evidence, look at these trading volume numbers compilled for a one week period of time, as provided for by a recent Barron's magazine. Read these numbers. 9:30-10:00 a.m. 87,262, 10:00-10:30 a.m. 32,506 ,10:30-11:00 a.m., 26,671,11:00-11:30.a.m. 25,731, 11:30-12:00 p.m. 24,464, 12:00-12:30 p.m. 21,204,09 12:30 p.m.-1:00 p.m.20,266, 1:00-1:30 p.m. 20,434, 1:30-2:00 p.m. 19,858, 2:00-2:30 p.m. 20,880, 2:30-3:00 p.m. 23,397, 3:00-3:30 p.m.27,189, and then watch the last half hour of trading explode in trading volumes! The 3:30-4:00 p.m. trading volume number is 455,043. What an increase in trading volumes. Now back to Rivian and more specifically the 14.5 series of Calls that traded upwards on the day. Is there a chance the stock could go up in it's last forty five minutes of trading? Here now is how they closed out the day.

All of this is to point out the power of "end-of-the-day" option trading. Here is it's one day closing chart. The Call options in the last 49 minutes of trading jumped from $.60 to $.83 cents. On ten contracts that could be a trade.

Now a look at Thursday's opening. The stock is losing steam and anything could happen to it. Holding onto it after the close on Wednesday would have being a dangerous adventure.

Now Thursday's action. A quick selloff on the opening and then a slight comeback as time progressed.

It's going to take a jump tomorrow to save these Calls. Now Friday's action.

Look at the bounce on the opening.

Yes there was a Friday morning bounce which rewarded all of the Thursday option players who bought in! BOTTOM LINE. Wednesday, the day of the news release was not the day to be buying Rivian Calls. Thursday was the day to get in and Friday morning was the time to get out. The next time a positive event like this happens mid week to a stock be cautious about playing short term options on it.

Comments