First this.

Yesterday Tesla one week calls went screaming up. Look at it's five day chart. Look at how the stock went up six dollars on the opening.

So here we are now at Tuesday June 4th. Might the stock jump again? Here is where this week's Friday's two dollar "out-of-the-money" Call options are now trading at. The question is can you jump in now and make money on them by the end of the week? Is playing Telsa Calls that easy? As you can see from the above chart May 30th and June 3th produced outstanding returns for short term Telsa Call holders.

High volumes of contract sales in this series have happened in the first fourteen minutes of trading. Will yesterday's upward party now start to kick in again? It's now 10:00 a.m. Would you feel comfortable in the saddle holding onto one of these 'out-of-the-money" Call options waiting for a three or four dollar uptick? Is that a fun game to be in?

Now what? At 10:00 a.m. it started to dip and at 10:17 a.m. the Calls were losing steam. Watching the minute to minute action can drive you nuts. It now doesn't seem like this will be a morning where the stock jumps up six dollars on the day.

Here now is how it's one day chart looks a few munutes later at 10:30 a.m.

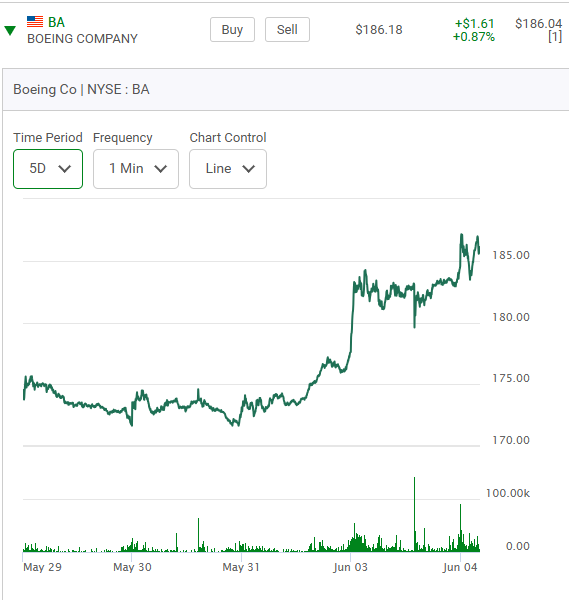

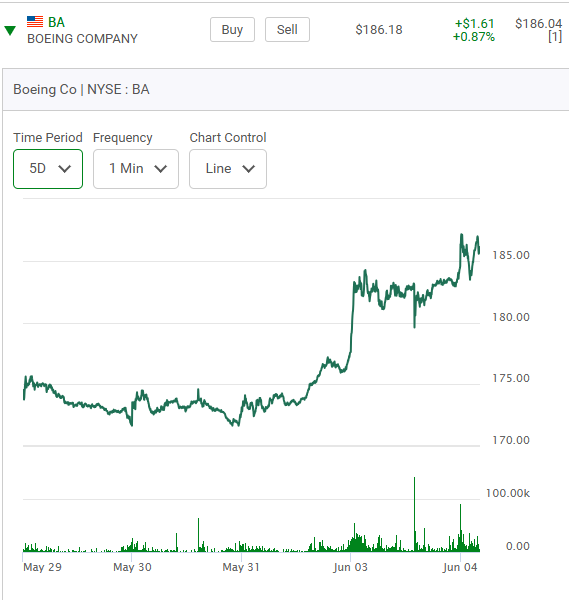

Welcome to option trading. We are now watching an "out-of-the-money" option series very much in limbo. If you were jumping in for a quick flip I am sorry to say it just didn't happen. But wait, it's still early in the game and you still have the rest of the week to make good on this position. Side thoughts. Telsa jumped on Monday morning. So did Boeing. Look at it's five day chart a see the bounce.

Both Boeing and Telsa as of late have bounced on Monday mornings after an absense of trading over the weekend. That "time-out" period allowed as it often does, for a change of sentiment. Thank goodness Boeing didn't have any airplanes crash over the weekend. Why you might ask yourself were you not chasing that action? Why are we now stuck watching Telsa at this particular time? Is this a prudent time to reflect apon our entry point if we did actually buy into this postion? One thing is for sure. This position is now totally in limbo. That's not what smart option trading is all about. Let's now and jump ahead to the close of the markets on Wednesday June 5th. The trading week now has only two days left to it and Telsa seems stuck in the mud. Here is it's five day chart.

So how are the $177.50 Calls doing that we started to watch trading at $2.83 per contract? Here they are.

The "open interest" number has gone up. I don't know if that matters all that much. The old adage is that Tuesdays are not the best day of the week to be purchasing Calls that expire on Friday. You are paying to much for time value and can take a hit if the markets ever start to go sideways. That's wht happened today. There is still a chance that this Call position could do wonderfully well. To be continued. Now Thursday. It offered an opportunity to cash out with a small profit at one point in the day. Can you see how it rebounded off the low of the day? Yet it's five day chart going into a Friday looks a touch overbought.

Finally, here is Fridays action and a look at where the $177.50 seies of Calls closed.

Tesla ran out of steam. If you followed the exercise of watching Tesla trade all week you would better learn where to pick your entry points. As a final point to leave you with, here of next week's slightly "out-of-the-money" Telsa Calls. The game begins all over. To be commented on Monday! *** Can you see how expensive these options now are? No one is giving away free money.

Comments