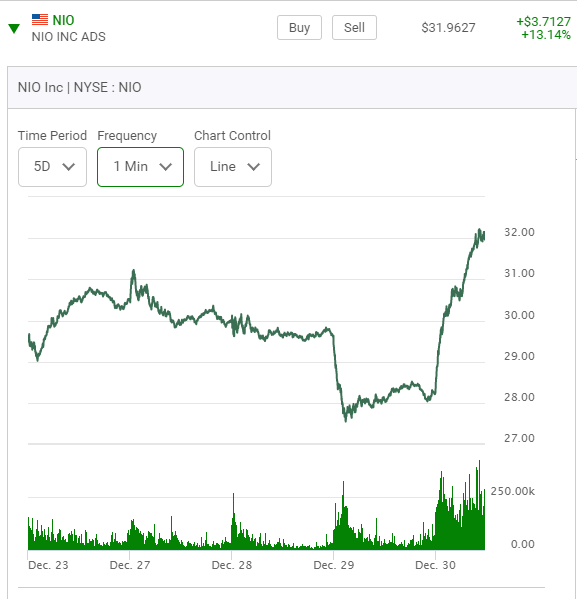

Let's look at a $30.00 stock jumping upwards in price on Thursday morning last week. It was Nio, a Chinese electric vehicle maker and earlier this year it's stock price was double what it is at now. Nio an interesting stock to play. This stock has a history moving up and down wildly.

Let's start with the early morning action on the 28 dollar series of Calls and then the 29 and 30 series. The 28 series Calls opened at .35 and within the first 33 minutes of trading jumped up in value to $2.16 The other two series of Call options had equally impressive gains. Look at how the slightly out-of-money option series attracted more interest.

Later on that morning it was higher again. Now for two observations or comments.

1) The stock was rising in price in anticipation of a news release about production numbers due out the following day. Here is what these production numbers ended up looking like. Also shown below is a five year chart of this stock. Only two years ago the stock was trading for one-tenth of it's current value! Yet investors sitting on this stock have also watched it drop in price by half from the highs of this year.

2)

Now let us look at one series of Puts, the Dec. 31st 30 series of Puts as the stock surged upward in price in the first opening thirty minutes of trading. Just over 2,800 Put contracts traded in the first 30 minutes of opening trading. Contrast this to the 22,000 or so Calls which traded in this same series. These Puts and the 31 series of Puts both ended up expiring worthless the following day.

The Call buyers were correct in their thinkings. Early morning buyers where able to make money on this rally. Here now is a five day chart showing how Nio closed out the week after it's Thursday surge. Trying to play the downside in a case like this would have being a mistake. Nio remained relatively strong on Friday, the day their production level news came out.

* Part three of this story. Tuesday Jan 4th. Nio sold off to a slightly lower trading range.

* A June 6th 2022 update. Times change. Here is a three year chart. There is talk about delisting Chinese stocks because of accounting irregularities.

*** Stocks in the twenty dollar price range are in general difficult to pay options on.

Comments