Let's begin with a look at Monday's action on the 15 series of Calls. At the low point today they were priced in the eighteen to twenty dollars (per contract) range. If you are going to purchase short term Call options on stocks in the $15.00 price range you should be buying them in multiples of let's say 20 or 30 at one time. Yet wait, once bought in there are no guarantees that the path you are about to embark apon will be clear sailing. Let's just watch them for a few days this to see what happens. You are hoping the stock will pop twenty five or fifty cents. It helps if you are following what is happening in the automobile industry. Look at how this stock was trading at a half dollar more a share only a few days ago. Will it rebound?

Going into the second day of this watch does it look like it could jump up again? Day two. Little change right? Yet that's not entirely true. Look at the opportunity presented to get out on a mid day bounce. The Call options bounced up to thirty-five cents from twenty cents so if you were sitting on thirty contracts and you caught it, $600.00 would have gone up to over $1,000. If you held them, would you then be smart enough to get out? Not bad for a one day move. It all happened in a twenty minute period of time. Look at the chart of this action below.

Why not play Telsa options you might ask? That stocks jumps up nicely at times. If you spend a little bit of time pricing them out you will quickly realize that they are prohibitively expensive to purchase which makes them very difficult to play. Ford options in contrast, for lack of a better word are more jitterish. I like them and they are regularly one of my "go to" options to play. It helps when the company is on a role releasing good news.

Here is what happened on Wednesday. Breaking above the fifteen dollar are share price point now looks like it is going to be a struggle.With only two days left in this weeks Call options the time value aspect of this hold begins to take a toil on these options. The fifty cent pop on these options is now less likely to materialize. Tuesdays little mid day thirty cent pop now seems light years away.

Let's see what happens next. On Thursday the stock slipped down again to under the $15.00 mark and the Call options could be bought for .07 or .08 cents. What now are the odds of good news and the stock rebounding upwards? It seems to be churning and going nowhere.

Now here they are on Friday morning at 9:38 a.m. Is there still hope for the day? If you bought in at the close yesterday will you be able to make any money? Not really as the stock opened lower.

Look at how they traded for .03, .04, and .05 dollars a contract in the first hour of trading to then jump up to .14. That's a double or triple on a Friday morning for those option players who got in on the close yesterday or who got in this morning! What a reward for anyone brave enough to buy in. Now look at how at the end of the day these options ended up expiring worthless.

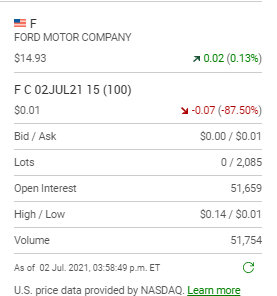

Now the end of the day.

What is the value in reading all of this? First, it was an interesting week on this 15 series of Calls with one short term trading opportunity on Tuesday and one trading opportunity on Friday morning. The issue of a chip shortage put a damper on the production report numbers which came out today and Ford has announced plans for extended summer shutdowns. So bad news and then more bad news. Playing options on stocks like this can be stressful because any bad news has the chance to wipe out your entire investment. Here now are the "Bids-and-Asks" on the 15 series of Call options that expire next week.The stock will be starting the week at a price only three cents lower than it started the previous week. Just watching these options trade can be a full time job in itself.

Comments

Post a Comment