This blog may seem to be lacking in content. It is only to say that one should not purchase "last week" - "Call" options on Monday mornings.

Typically Monday morning aren't good entry points and case in point is what happened to "Caterpillar" yesterday, a Monday as it dropped over four dollars a share.

One of "Caterpillars" characteristics, which in some ways is a good thing and in some ways not so good is that it often moves upwards or downwards in price on "no news". Yesterday was on of those days. The difficult part is, if you trade the options on this stock on a regular basis like I do you sometimes have the urge to want to jump in a play the upside whenever you see it sell off in price. This itch to "get back in" is most prevalent at the end of the first thirty minutes of trading on a Monday morning. This time "Caterpillar" seemed to be taking a hit and if you were able to buy in and catch a reversal you would be a hero and in doing so you would be able jumpstart your week of trading?

I got sucked in yesterday. I bought in as "Caterpillar" continued to tank all day. How do you learn avoid this trap?

There is one obvious way. Remember I have talked about having individual screens set up on your computer of sectors of stocks that you are watching like retail, automotive, spacs, pharmaceuticals or whatever you happen to have an interest in. In this case "Caterpillar" was the only stock on my list of "big movers" that was down. That in itself should have told me to stay away from the "Calls". Here is a look at the "Caterpillar" 245 "Calls" on the Monday morning selloff.

Shown above is an 11:30 a.m. chart.

Now that it's down over four dollars in one day can we expect a rebound? As the hours dragged on in the afternoon the stock stayed pretty flat. Nobody knew why this happened.

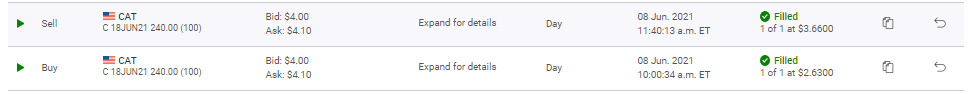

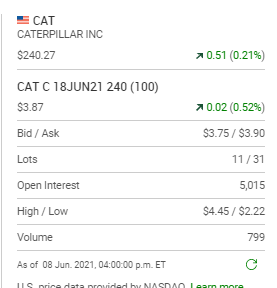

Now it is Tuesday. Would this be a good time to catch a rebound, this being day two in the week? Look at yet another drop on the opening? Yes, it could be a good time however at such a moment when your buying into options on a falling stock it's sometimes best to pick with an option with an extra week of "time value" built into them. Here now is what I did.

This series of "Call" options at this particular time look attractive.

This series of "Call" options at this particular time look attractive.

Comments