Thirty five minutes into the trading action and here is what is happening.

Trump is big on tariffs and is vocal on Deere products made in Mexico.The 410 series of Puts on it are up 367%.

The 405 puts are up 920%. They closed the previous day at .51 cents.

Volumes of trading are light. Traders are not taught to trade in one day options and for all the hype about Ai trading no inroads have being made in this regard which is something I find strange. What value has Trump added to these two stocks this week? None really. So why such extreme forward looking thinkings? It's 10:28 a.m. so we are still in the first hour of trading. These options expire at 3:30 p.m. so there is still four hours of trading life in them and the Djia is up 239 points.

Is it now time to catch a rebound? Maybe. Well maybe only to those traders who caught the selloff and profited this morning. Yet then again one would be fighting thinnly traded Calls and Puts both on the buy side and on the sell side. In other words you would have to buy something a little bit closer to the asking price and sell a little bit closer to the bid side. It would have to take like a three dollar price swing in the right direction before you would be able to profit from such a move. We are not in ordinary markets so where might a new wave of optimism come from.? Look at how these two Call option series are trading a few minutes later at 10:27 a.m. First the stock Deere and one series of it's Call options.

Now Caterpillar one day Calls.

Now here is the end of the day chart on Deere and a look at the 410 Puts.The stock dropped another five dollars from where it was trading at when we looked at it this morning.

They are up 581%. (The 400 series of Deere Calls we considered at at 10:27 a.m. are now toast). It's hard to believe that it could drop $17.10 on the day. Now a look at how Caterpillar traded on the day. It closed down $14.86.

Here is a look at how one of it's series of Puts traded on the day. This time it's the 400 series of Puts which were about ten dollars "out-of-the-money" going into todays action. Catching action this extreme is admittedly very difficult to do.

These Put options were up over 1,000%. How do think Deere and Caterpillar did on the following week which ended on Friday November 15th? First Deere.It was down $4.29 on a week when the Dow dropped 1.2%.

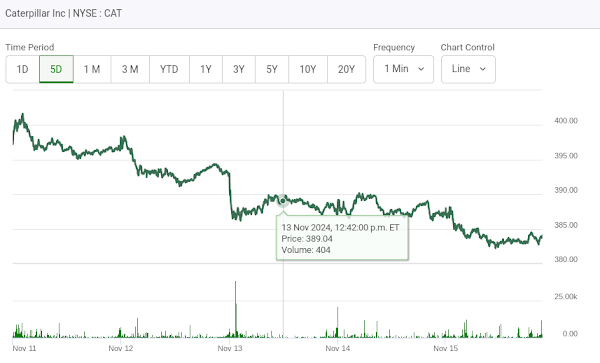

Now Caterpillar.

It lost $9.30 0n the week. Now a 30 day look at Caterpillar.

His tariffs might cause reciptocating tariffs and might slow consumer spendings. The long term effects of tariffs are still being debated. Now that x-mas is coming most traders with a mid term horizon are going to sit back and wait for a better thesis to emerge in the new year.

Comments