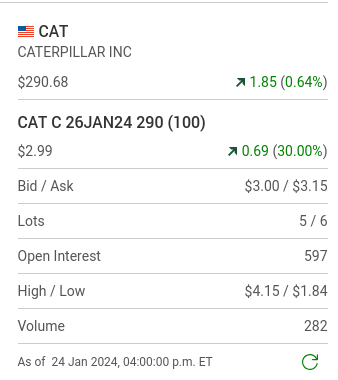

When a stock pops on a Monday morning can you go against it? That is a logical question to ask. Here is Caterpillar on the opening.

It's an interesting chart because it is hitting a resistance level. What do your instincts tell you to do? Here is a look at the Puts and Calls.

Now the Puts.

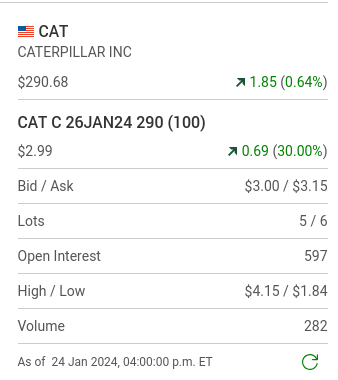

Yes there is more action in the Calls, there always is. Both look pretty inexpensive given the recent volatitity in the stock's price. Now consider this. Caterpillar is the largest manufacturer of heavy equipment in the world. Why are the open interest numbers of "near-to-the money" options on it so low? One of the reasons is that the stock is mostly owned by institutions who make buying and selling decisions based on more sophicated tracking tools than what are made available to retail traders. Retail investors/traders, in my opinion are to some degree handicapped for this reason and option trading on this stock is always more of a gamble than it is on other stocka like Telsa for example. Telsa has a near mind numbing number of weekly news releases which help to play into buying and selling decisions. Telsa options in contrast to Caterpillar options can trade 50,000 or more contracts a day on "close-to-the-money" option positions. Now look at the movement on Wednesday at the close and how the Puts and Calls we are watching closed out. Both are lower in price. Their remaining time values have shortened. First the Calls.

Now the Puts.

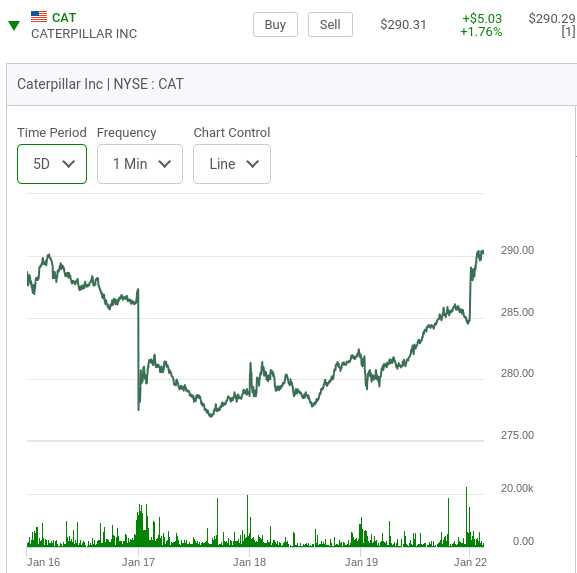

Now lets jump ahead to the the opening action on Thurday morning. First a look at the five day chart going into this action.

Now a look at the premarket bid and ask.

Notice the bounce?

Now this. Notice the Call option prices two minutes into the opening bell?

So the 190 Calls we first looked at on Monday morning at $3.75 are now at $6.50.

Now remember how I referenced Telsa options as being more retail friendly to play? You might think differently after showing you its chart this morning.

Both Caterpillar and Telsa stocks can suprise. Happy trading. *** Here is how Caterpillar closed at the end week. Had you bought a Call and Put at the start of the week you would have made money if you held onto both of these positions umit the end of the week.

Comments