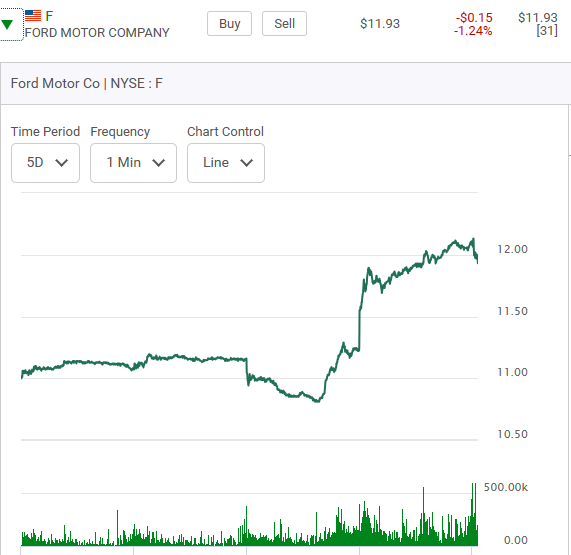

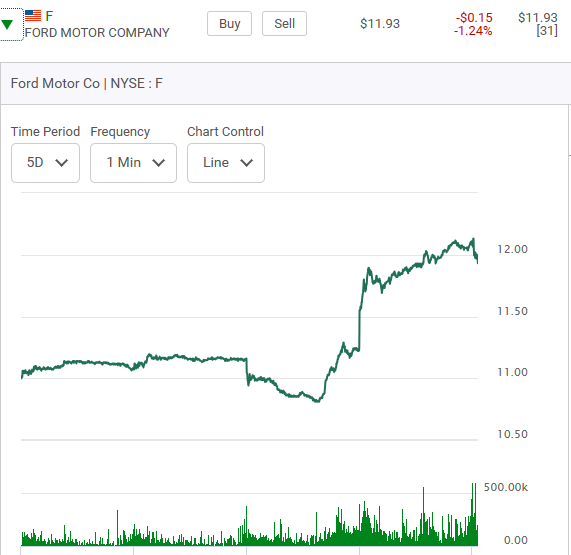

Stocks like "Ford" in the ten dollar range can suprise. "Ford" is actually at twelve dollar U.S. however that is close enough. A move of like forty or fifty cents in a one day rally or a one day sell off can really can move the needle on Call or Put options that expire that day. I have witnessed two cent options ($2.00) options on "Ford" jump to fifty cent ($50.00 options) in two or three hours. It happens more often than you might think. So what happened on Friday this week with the "Ford" 12 series of Calls and Puts. Let me walk you through some of the action, or lack thereof. I will start with the five day chart of Ford a few minutes into the Friday morning trading session. Can you see Ford starting off with a little dip?

Now the early morning 12 series of Calls, nineteen minutes into the action. Ford is down and this series of Calls are "out-of-the-money" Could the stock rally? The stock is down 15 cents on the opening and the 12 series of Calls are down nine cents. They expire today and would have to rally four cents from it's 9:47 a.m. level just to return to it's striking price.

If you look at one one day chart on Ford that we posted further below you will see how it dropped considerably more shortly thereafter. Here also are now the Puts.

Look at the number of open positions and the volume of contracts traded. It's substantial. Now let's look at the offsetting Puts. They are still in the money two cents! Bid .08 ask .09 is actually cheap but any uptick to this stock would make these Puts near worthless. What next? Trades at 11:22 a.m.. First the Calls.

What do you notice here that is different? Well, Ford is now up $.09 cents from our previous readout, however not enough to move the needle on the Calls upwards. The time to expiry is now noticeably shortened, it's afterall now has to follow the "please-be-out-by 3:00.p.m", Friday rule. These Calls are now not looking all that attractive. What about the Puts? As you can see they are getting squeezed even harder.

At times this is not a fun game to be in. It's also a game where you can be broadsided by news releases. More often than not these occurances are more likely to occur "pre-market" or during "early morning" trading activities. So what next? Here is how these two series of options ended out closing the day. First the Calls.

Now the Puts.

Here is how the stock traded on the day.

Who made money trading these options today? First traders who bought Puts around 9:35 a.m. when the stock was well over the$12.00 mark and who got out before 10:00 a.m. Second, the traders who bought Calls around 10:00a.m. and who then got out around 11:15a.m. It sounds simple but it isn't. Try and track Ford one day Calls and Puts each Fridays for the next few weeks to see how these patterns emerge. It's certainly not a walk in the park. +++ Now this. It's Dec 18th a Monday and here are the 12 Calls again, this time expiring at the end of the week. Some traders buy in quantities of 50 or 100. One strong opening lifts the prices of this series of Calls back up tp $.20. It could be a quick flip.

Now Tuesday trading.

The bottom line is that all this activity nrver ends.

Comments