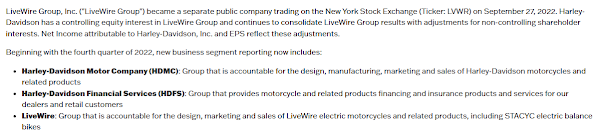

Livewire is the product of Harley Davidson merging its electric bike division with a special-purpose acquiston company. Doing this pulled in new start up capital. That was a good plan. Grab some money when the appetite for new issues was strong. New money willing to chase the Livewire dream.

A third quarter earnings report comes out for Harley Davidos/Livewire on Oct.26th.

What's next? Well, who wants to purchase an electric bike in either the near term or in the mid-term? It has "range bound" issues. It doesn't go very far before it needs recharging. So it's a double whammy. If you wait a few years you could buy one for a little bit less money as their prices keep coming down and get a newer model with more distance. Right now it's not like you can pick one up at your local Harley Davidson store and drive it 500 miles out into the country to go camping. Livewire tanked during it's first year of trading. Early production numbers were very small (and continue to be small) and their retail pricings were set somewhat high. Last quarter production numbers disappointed. Livewire also has "Stacyc" a division building electric bicycles. See my Livewire May 14th blog.

Who really wants the first generation of anything new? No one really cared that the stock Livewire struggled because everyone knew Harley Davidson would be there for them in support of the cause. It's an electric version of what they already make. They also knew that this new venture wouldn't be profitable during the startup phase. So in some ways it was the specutlative investors paying the way to making it happen. Other EV players in this space like the Canadian company "Electramechanics" with their three wheeled electric vehicles do not have the luxury of a partner offering advise and encouragement. Livewire does. Yes they have initially gotten off to a slow start but finally their electric motorcycles are creating a stir. Why? Well, driving an electric motorcycle puts a grin on one's face.(In China the use of electric motorcycles is a no-brainer). What riders in North America are now discovering is that the Livewire electric motorcycle is a rocket-like bike to drive in urban settings. You can sneak up on other vehicles without them hearing you and you can take off quicker than anyone else when driving in slow moving traffic. Watch the youtube videos on them. Plus, Livewire is now pricing their product offerings a fair bit lower than what they initially priced them at when first came out. There are other issues. High interest rates mean fewer people are willing to shell out money on luxury purchases. (Harley may now be offering special financing deals). That plus with a range of something like 95 miles they are basically useless for taking on trips.

It could be said that Livewire will not be commercially viable until the range issue gets figured out. Perhaps that could happen quickly. Here is what Livewire is trading at (a 4 year chart - look at the price swings - it went public on September 27Th 2022) and look at a one year chart of Harley Davidson. It was trading over $50.00 at one point this year.

Now Harley Davidson.

Here is what a January 19th 2024 Thirty-one series Call on Harley Davidson now cost. They are just "out-of-the-money".

$205.00 a contract. Look at the chart. If Harley moved like three or four dollars upwards over the next three months that would produce a decent return. Even a two dollar move in the next month would move the needle. Notice the low volume of trading. These are not Calls you can day trade but rather Calls to check on only every few weeks. Also noted is that Harley Davidson has a very long history of trying to deal with trade tariffs. The winds may be changing as the Biden administration is reviewing some of the tariffs imposed by President Donald Trump. An article in Barron's on Oct.16th mentioned this information without providing any additional detail. Now the options on Livewire. This time we are looking at the "in-the-money" April 2024 Calls. Notice there is no liquidity in this particular series. This means a couple of things, one being that once you buy them you are kind of stuck with them. The option makers will not want to buy them back without you taking a hit if the stock continues to trade sideways. Can you see the wide spread in the bid and ask. If you want in don't chase them. Watch what they sell for over a period of a few days and maybe try to buy in on a day the markets are tanking.

If the stock ever went back up to $12.00 before April you would be a hero. As a general rule I don't like speculative thinly traded options on "what could happen situations". Livewire falls in that category, Harley Davidson not so much so.

I want one. ** Look at this. It is now Oct.26th.

Livewire is up .53 cents and there are still only 13 contracts in total traded in the April 19th 2024 Calls. Notice the "bid and ask" are up. Trading in longer term options requires patience. More Oct 26th news.It's not good news.

Now Harley can get back to business. *An update. Nov1st. Prices are dropping. The stock is shooting up.

Comments