It happened with no warning. It just dropped for no reason. Early in the morning it dropped and then stopped and looked like it wanted to make a rebound. Then it sold off further.

The company announced one employee of twenty years or so was being given a new position. That's the only news I could find on it. The following day, stories emerged about how other stocks in their sector had problems. Caterpillar is a company with relativey few news releases and that's why many options players like to trade them. In their earning reports they compare their profits and losses in all parts of the world they operate in. Investors like to see that. Today was different and the stock just dropped. A thirty day chart shows how that it was possible.

Now what? Earnings come out in about two weeks and they are expected to be better. Our world is being torn apart and the equipment Caterpillar makes to rebuild our planet is in high demand. Caterpillar is also the kind of company that can pass on price increases to their end users. What happened today was a "one off" yet I would't be to quick to buy back in. Maybe the lesson here is not to holding any Caterpillar stock or Call options two weeks prior to an earning's report. Let's see what happens. Oct 19th, the day after. Now we are back in the price range of where the stock closed 90 days ago.

Will it drop on the opening and turn around and go back up again? Let's see. Call option traders have learned to stay away from downward action such as this. It's difficult to stay awy from Call options after a stock has dropped all week. Caterpillar has had a bad week. He is how the 252.50 Calls which were slightly "out-of-the-money" opened on Friday morning. Traders stayed away.

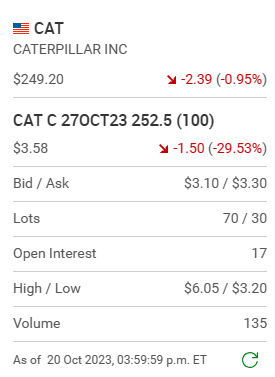

Anyone in the 252.50 Calls at the end of the day got smoked as Caterpillar closed at $249.10. Here is how the markets and Caterpillar ended up closing on the week.

Can a stock keep dropping forever? One would think that a weekend would offer relief and possibly a change of thinkings. Here is Fridays action on th 252.50 series of Caterpillar Call options that expire next week closed today and the 255 series of Calls. Can you see how option traders are opening up new positions. That is to be expected when a stock potentially becomes oversold. This game is never ending.

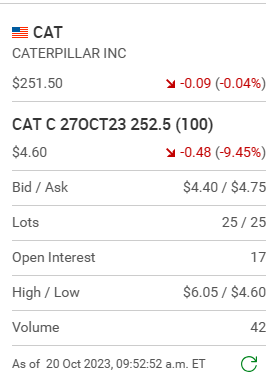

Now for one final observation. Forward thinking Call option players might have being tempted to pull the trigger and purchase some of these "one-week-out" 252.50 Calls on the opening this morning, even thinking of cashing out later in the day on a dead cat bounce. Look at how expensive they were at 9:52 a.m. Dead cat bounces on Friday seldom happen.

Option timing in option trading is everything.

Comments