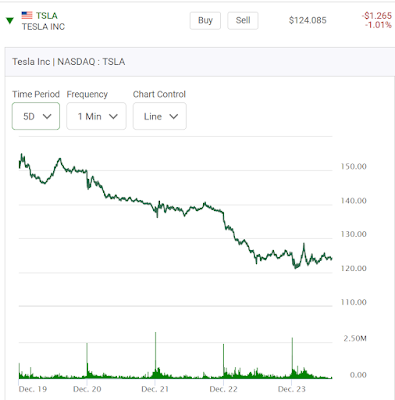

I want to tell you a few secrets. This is going to be a tough read. First, there is a revolution of sort, happening within North American stock market trading. It's the subsection of trading called called option trading and books can't be written fast enough to tell people what these new changes are all about. Pick a stock, pick Nio. Did you know that you could make a career out of playing just that one. Start by trying to make $500.00 a week trading it. I am talking about playing the options, not the stock itself. Option prices on this stock often double or go half price in one trading session. Read my blogs on this one. The strange thing is you really don't have to know to much about the company before you can start trading it. Try following it's chart and try to figure out daily when is best to get in and out. It helps to be also watching what the DJI index is doing at the same time. Some traders opt to play the future market but that's a different game. It's a different way of trading as you are able to open or close a trade at four in the morning if you wake up to use the washroom. It's not like the old days when you might only want to buy one stock and hold it like Apple for two years. Two of my friends are female Uber drivers and neither trade the market. Well that's not true. One bought Uber stock and lost $2,000 when she sold it and my other friend has a financial adviser that she seems to stick with for whatever reason. They review things once a year. On snow days like we have right now they can make $350.00 in a day if they drive fourteen hours. Truck drivers have their daily hours on the road capped. Uber doesn't. They should. What I hear from both of them is that a suprising number of their male passengers are daytraders. They say the same thing about their dating site app experiences. That's my first secret. The number of daytraders is skyrocketing. Maybe you already know one. Another secret is that you don't have to be super knowable about stocks to day trade. You just need the stamina to keep going at it. It's up and down. Just nail it. Now let's review this five day chart of Telsa.

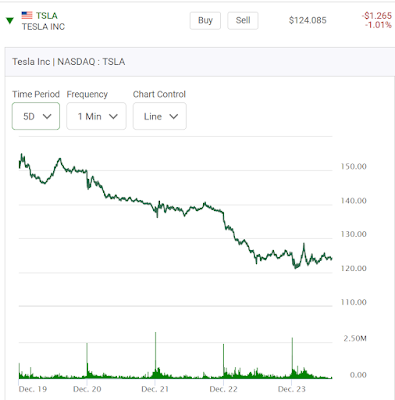

This week the street is of the opinion that Elon Musk is trying to bounce to many balls at once so it dropped. Might something happen over this upcoming weekend to make people think differently? Now look at this five day chart showing Boeing.

If you love to study charts then the upward breakout it had on the morning of Dec 21st was highly coveted. The next five day chart is Caterpillar. Look at the six dollar rebound in just had in the last day. Finding something interesting to play is never a problem.Try to stick to things you think you know.

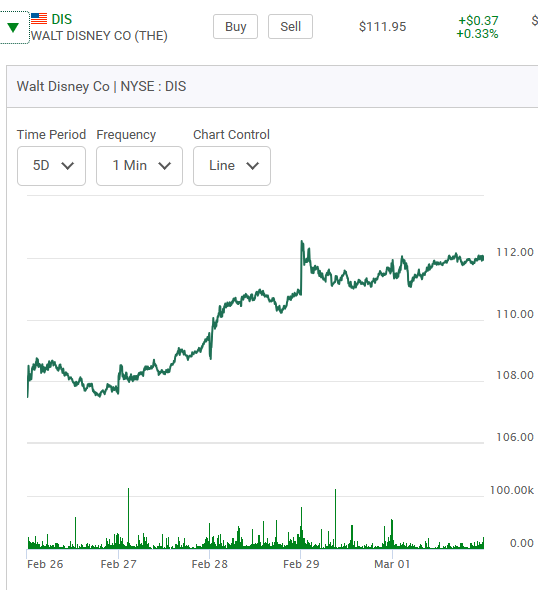

Day trading options as mentioned is becoming big time the norm. Well not so much in Canada. Paying commissions in-and-out all the time makes daytraders in Canada less inclined to want to make frequent trades or trade only in higher priced securities where you are purchasing fewer contracts. In the U.S. retail traders have the privilege of purchasing stock and stock options, commission free. Go figure. Doing so has increased the incentives to make trades and using options as a trading vehicles lets you profit on successfully anticipating the slightest directional move in any stock. Buy a Boeing Call option at 11:11 a.m. at $350.00 and then cash out at $385.00 ten minutes later if the stock rises thirty cents. Doing the trade is free so getting out quickly on a position going the wrong way is not going to cost you as much. Hang in on Boeing for an hour if it seems to be going the right way and see if you can make $100.00. It may sound like a lot of work but it isn't. Trade five different positions in one day skimming off profits here there and avoid the risk of holding overnight positions. Do your vacuuming at the same time.

Am I an advocate of this type of trading? Yes. Put your analytical skills to work. I think the Canadian banks now need to rethink the charging of commissions aspect of their trading platforms. How can they charge their Canadian clients to use their trading platforms and let their American customers use it for free? If there where collectively no commissions charged on trading stocks and options in Canada then more people would find in this type of trading. Let's not continue to make real estate in Canada the game of choice to play.

Comments

Post a Comment