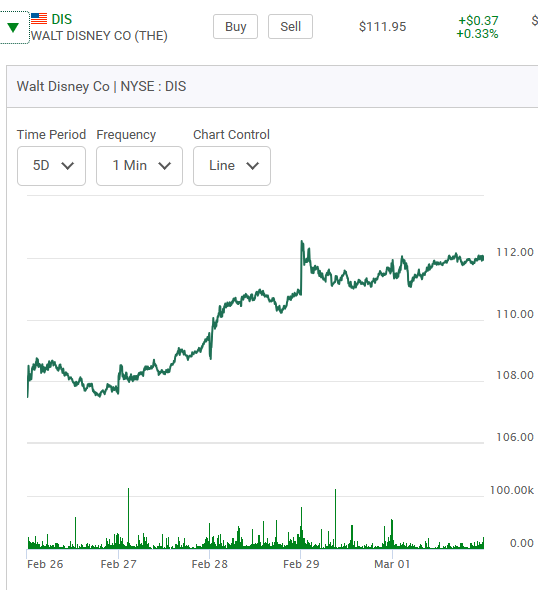

First, it's one week chart.

Here is one of the reasons why it is up. India is a marketplace with 750 million potential viewers!

I have talked about Disney in some of my most recent blogs. Short term Call options on it did well this week as they did two weeks ago. So one question is - "How can you anticipate action like this?" Well it helps when the stock is in a general uptread. Here is it's three month chart.

India is not the easiest country in the world to do business with. Starbucks went there in 2012 and now over ten years later it has only 390 stores. Ford pulled out in 2021 after starting to build cars there in 1926. The number of Domino Pizza stores is growing.

I admit that this isn't an exhaustive analysis but my point is we should not expect this Disney news to rocket the stock to the moon. It did however create a profitable trading experience for option traders for a couple of days. Buying in on news as it is being disseminating is often a recipe for disaster but this time it worked. It's kind of like waking up a sleeping elephant. It takes a few days for this kind of news to be evaluated. On a different note news about the EV maker Fisker. If you watch sports on t.v. you probably watched countless television ads promoting their beautiful "Fisker Ocean" model, one of a few they have. Red or whatever it is, is not one of it's most attractive colors.

The company has news.

So here is the thing. Yes they have no money but they have created a "larger than life" brand name which has immense value. The problem now is that penny stocks and speculative stories often do not have happy endings. I would like to see it survive. Next, the Lion Electric the Canadian electric bus building company which has recently branched out into the U.S. to catch onto some of the government "go-green" incentives found there. The timing of these incentives is never an exact science. That's part of it's current problem. At least they are still in the game. Before going electric they built non-electric busses, mostly at a loss and never in qualities large enough to satisfy the number of orders they always seem to have on their books. It's been an exhausting ride for shareholders. Laying off some of their night workers is not going to help much. Other bus making companies have failed in the past. One big problem has always been warranty servicing cost and the difficultly of orchestrating a network dealer service centres.

Now here is a link to listen to their conference call. It's another interesting story but one that has no quick fix. But wait, I tried to log on only to be told the access codes they provided do not work. That's not good news.

Finally I want to breifly mention Taiga. They are also a Quebec based let's go electric company. Earnings come out March 26th.

They make electric snowmobiles (there was no snow this winter) and electric watercraft. All they seem to do is lose money. Big money. The question is, like the question for Fisker how can they survive?

The watercraft division looks promising however they have wasted so much money to get this far and their expenses are ballooning. Total cash is 5.81 million and total debt 52.83 million. They are guilty to some degree of not being transparent in what they are up to and shareholders must be furious. The volume of trading is next to nothing. It's a difficult situation to be in. Stay away.

Comments