The markets crashed 500 points so play John Deere Puts.

It sounds simple but it isn't.

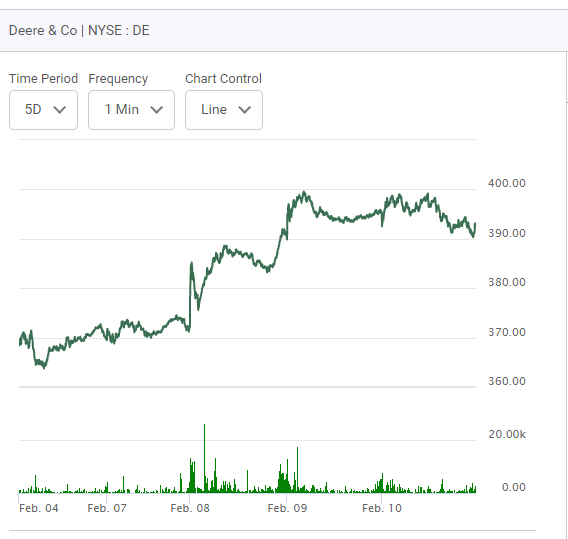

Look at these charts on it today. First a mid day chart which shows Deere jumping up quickly on the opening and then a one day chart and finally a five day chart.

So I decided to play it on the downside thirty five minutes into the trading session after it jumped up on the opening with a Put option that would expire on it the following day. I was fishing. It was the 390 series of Puts I was looking at and they were about eight dollars "out-of-the-money". Sound crazy? Well I wouldn't actually need a drop that large. A move of let's say five dollars to the downside during the day would be enough to generate a profit.

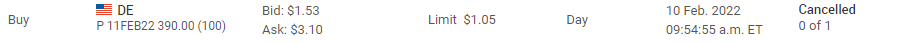

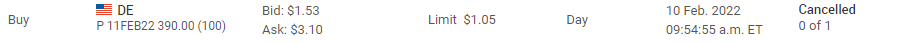

Here is a chart showing the 390 Puts for the entire day and a cancelling of a my buy order early in the morning.

At 9:54 a.m. I cancelled a buy order for a 390 Deere Put for $1.05 dollars when they were trading for about $1.10 This buy ticket was placed only about three minutes earlier. If you scroll up to the top of the three charts can you see how the stock shot up in price in the first thirty minutes of trading. That was my reasonings for getting excited about playing the downside on it. Had I not cancelled the order I would have gotten a fill around 10:00 a.m. or then again around 12:30 p.m. as Deere stayed strong until just after lunch. Then look at how this series of put options closed the day at $2.05 after reaching an interday high of $2.65. I missed all of this action. All of this is crazy you might say. You could be right! Look at how low the volume of trading was on this series of Puts. ...................................................................................................................................................................................................................................................................................................................................................................................................................................

Now for a look at how Caterpillar traded today, the day once again of a 500 point D.J.I. drop. It traded down on the day by .30 cents. What a strange looking chart. Around 10:40 a.m. would have being a good time to play it down.

Here is what I did and here is how Caterpillar closed the day.

Comments