What the heck? I thought farmers in the U.S. are in trouble. Isn't China cutting off it's pork imports. Corn prices are dropping. I thought fertilizer prices are going up and I thought there were canola oil issues? All that plus who can afford to buy new tractors and new tractors that need dealer only servicing? Deere stock as some anaylst are saying has moved up to much to fast. Deere's previous earnings report wasn't that good and at that time it was stated that the path forward would be challenging. An article I posted on April 30th said the following.

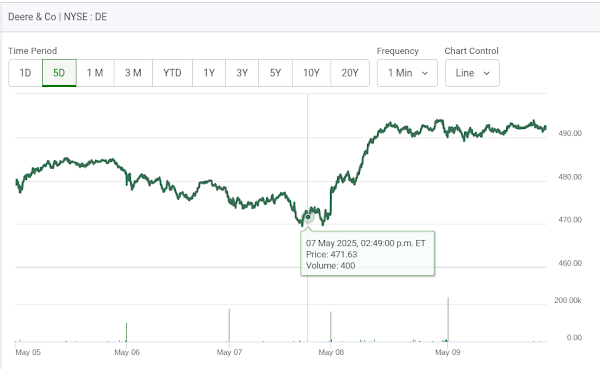

Then this week Deere jumped up $7.23 on the week. Trumph anounced he would lower the tariffs on China.

Now this, something I reported after Deere's first quarter profit report. I blogged about this situation back in mid Febuary. You can check it out.

Maybe this coming earnings report will be better only because the first quarters earnings were so bad. As mentioned above earning report on companies like this seem to be in an uptrend. Here is how Deere traded on the week.

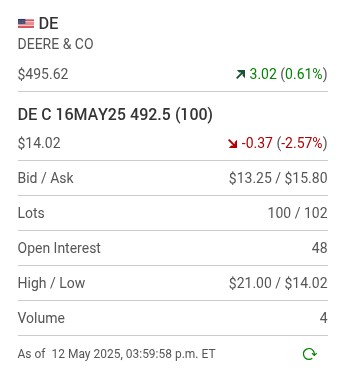

Now this, the price of both the Calls and Puts that expire this week going into this week. They are both prohibitively expensive so no one can afford to play them. Look at the low trading volumes.

Thursday was the day to get in when Trumph floated the notion on lowering the tariffa on China. Reacting to Trumph's news is unfortunatley the new short way of successfully trading options. A Monday update.

A huge upday with Deere jumping on the opening!

Here is how the Calls and Puts traded. First the Calls.

Now the Puts.

A few traders bought Puts on the morning rally and closed out their positions at a small profit to avoid being in the markets overnight. They were nimble traders. With tomorrow being a Tuesday and with earnings coming out on Wednesday it will be interesting to see how many daytraders want to be positioned to play the news up or down. To be continued.

Comments