Options on stocks in the $1,000 range often move 30%-50% or more on the openings on Wednesday or Thursday . The hard part is to anticipate correctly which way the markets are going to move. That's a fools game you might say? Yes and no. It may not be a game you ever play but it might be something to consider to put in your bag of tricks when you are on a role.

One thousand dollar stocks sometimes move five, ten or fifteen dollars on the day. If you have profits it's best to take them quickly. Costco, with Trump saying make them absorb the tariffs is a prime example of that. Let's look at this mornings action. First it's five day and one day charts.

Tuesday's trading was kind of choppy. Might it drop on the opening tomorrow? Here is a look at where the 1,035 series of Puts closed that expire this Friday. They closed at $8.50. It looks like Costco cycled up about five times yesterday. Given a weak market opening doesn't it stand to reason a three or four or five dollar will be inevitable? Some might argue that the logic of the exercise is overly simplistic. Perhaps it is and if you try it and get burnt a couple of times you will swear to never do it again.

Here is what happened this morning. The 1035 Puts closed the previous day at $850.00.

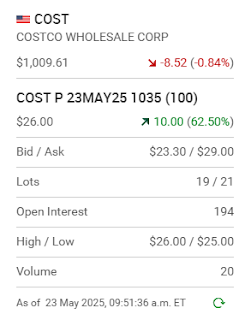

Here is what happened as of 9:37 a.m.. Wednesday are often the best day of the week to be trying this strategy. The gain in this case wasn't that significant however it sometimes is. Now here is how it closed the day.

In some respects they didn't really jump that much considering how the markets dropped so much. The stock dropped about $7.00 from the 9:37 a.m. readout and the Puts didn't seem to give full value for the stocks decline. But then again they were up 54% on the day. Costco is a strong stock and the bias is towards the upside. Thursday and Friday options can swing wildly. See some of my past recent blogs . Now this. Look at how there is next to no volume in them. The short term traders are now more likely chasing the less expensive "closer-to-the-money" options.

If your happy with these returns now might be a good time to get out. Thursday and Friday last week saw prices surge up. Or then again, play the upside looking for an oversold situation in the next hour or so.

To be continued. If you did nothing and held these Puts to the very last day when they expire here is how they were trading on that Friday morning.

What a ride if you caught it. What a reversal from the stocks climb on the previous week.

Comments