Do you remember Polestar going public at $10.00 a share?

Look at how it has struggled. It dropped further this week on a disappointing quarterly earnings report. Maybe next week it will bounce back again. It's still in business and advanced new models are soon on the horizon. It could be like the Nio report last week. Nio bounced back after reporting a quarter of lower production numbers.

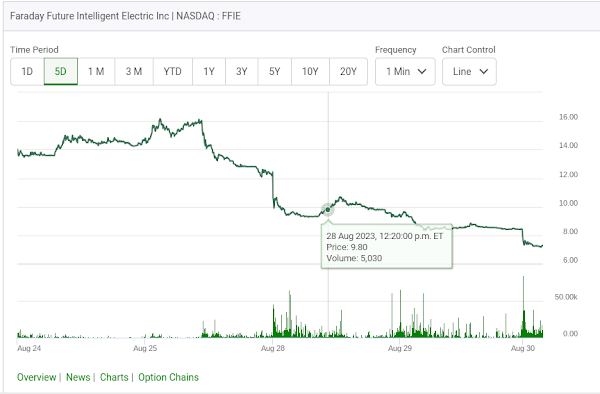

Other upstart electric vehicle companies like Rivian and Fisker are also struggling to be profitable. Remember I recently mentioned Faraday Future doing a 70 for 1 reverse stock split? How crazy was that? A ten for one reverse split would have got them over the magical $1.00 mimimum trading treshold and kept it as one of the most actively traded stock on the Nasdaq. Here is how it traded this week after their announcement. Their stock in now sinking into oblivion.

Then there is a newly listed Vietnamese company called VinFast with vehicles arriving to North America and plans to buld a factory in the United States. What a dumb time to listing a stock in this sector on the NASDAQ. I think the stock is in for a rough ride.

Down from over $80.00 at the start of the week to $29.49. What's to stop it from going to $15.00? Stay away until it builds it's new factory on U.S. grounds and gets it up and running. On a differing note, the big three auto companies in North American now have new companies like this one coming out of nowhere as competition. Competition is a good thing. Consumers are gaining more options. ** An Sep 6th update. The rough ride continues.

A Sept.22nd update.

EV stocks in this price range make me nervous.

Comments