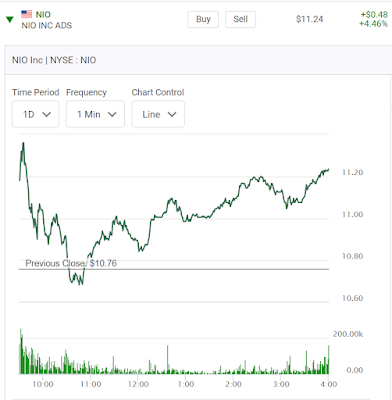

No one is giving away free money and option trading is at the best of times a difficult game to play. Nio, on volume of shares traded is often in the top five or ten list of number of shares traded in one day on the D.J.I.. I have written about trading options on Nio many times. First todays chart. It was up 4.46% on the day.

In at 11:00 a.m. and out later in the day. Easy right? Well not so fast. Look at this.

This was news back on Dec. 27th. If you're trying to play options on stocks like this in the ten and eleven dollar price range with only a few days to go news like this can knock you off you're horse. Now here is how the 11.5 Calls traded on the day.

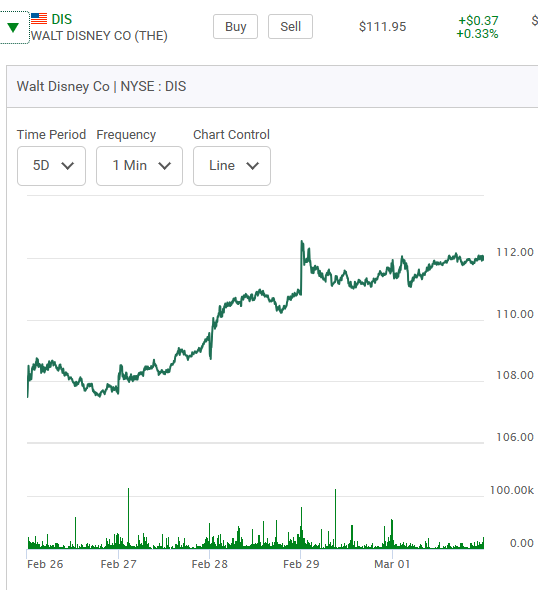

The high figure of .38 was at the start of the day.The low number of .12 was at around 11:00 a.m. with a rebound of a double in the afternoon. (Playing the 11.50 Puts in the morning would have acheived similiar results). Now let's switch gears and look at Ford Calls and their one day's action. Ford is stock which trends up and down on a five or ten or fifteen day basis while Nio swings up and down on a near daily basis. Both can be day traded.

Here is how the Ford 12.5 Calls bounced after 11:15 this morning. They to were almost a double.

Points to ponder. 1) Notice the volume in Nio option trading exceeds the volume of Ford option trading. 2) Note how they both reacted to some sort of stumuli that happened around 11:00 a.m. Note that both of these options still had two days of trading life left in them. Observations. 1) If one opted to trade in these two series of Call options one could do so without the worry of upcoming earning reports in the next few days or dividend payouts. 2) Experimenting in options like this takes practise. Note a focus on "out-of-the-money" options in both stocks which offer the most leverage. Holding overnight positions on Call options which are "out-of-the money" or being close to being "out-of-the-money" with two trading days of life left in them is not a recommended strategy. (I will show you later how each of these two options series ended up trading the following day). 3) What do I know about these two auto stocks that other investors do not know? Nothing really. I just know that Nio moves up and down quickly. In my last blog I talked about playing options on stocks that expire in one day when the DJI is surging up 700 points in one day. Today's blog in contrast is about what sometimes happen with options on stock in the $10.00 - $13.00 range with two days of trading life left in them before they expire. In "daytrading" one has to learn how to pick your battles.****** A look at Nio and Ford the next day. First Nio and the 11.5 Calls which now expire in one day.

Notice the nice 10:00 a.m. bounce. Now Ford.

Another nice upwards bounce. Notice the difference in how more traders are willing to hold overnight positions in Ford but not Nio. That's just the way it is.

Comments

Post a Comment