Caterpillar Calls November 29th, 30th .Dec 1st, 2022 and Dec2022

This blogging site is about Caterpillar Puts and Calls. Try to understand the logic of these trades. Yesterday the market tanked almost 500 points, the largest drop in the last couple of weeks. Here is how the Caterpillar 230 series of Calls which expire this Friday started to trade on Monday morning. For more that five minutes after the opening bell no one wanted to buy in. That in itself was a warning to stay away. Options with four or five days of trading life are difficult to play. Or are they?

So near end of the trading session, like two minutes before closing I thought about an upward opening of the markets on Tuesday. At that time afterall the D.J.I was down like 493 points!

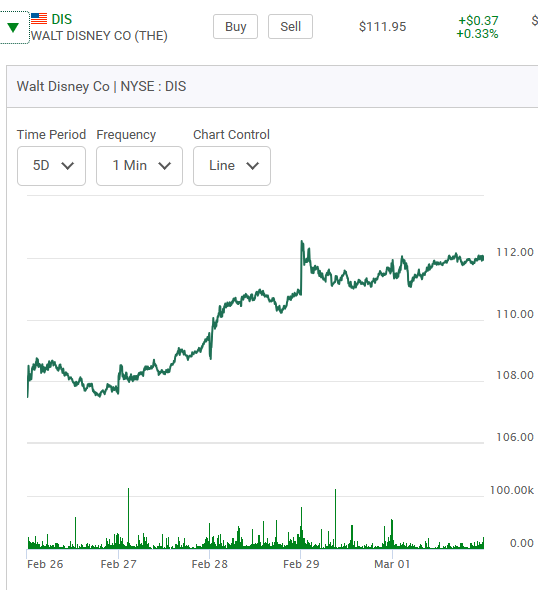

So with 116 seconds left in the trading day I bought two Calls on Caterpillar. I didn't buy the 230 Calls but opted instead to purchase the 232.50 Calls. They cost less and would offer better leverage if Caterpillar opened higher the next day. I purchased two contracts at $3.15 each. They offered me four trading days until they expired but all I was banking on was a jump from an oversold situation. In essence, I was playing the markets and using Caterpillar as a trading tool. It's slightly more reliable than playing stocks like Disney or Apple as of late.

So far so good? Now, here is a look at the Caterpillar chart I was greeted with just after Tuesday mornings opening. I struck gold so I got out.

Yes, I got out somewhere on the upward blip. Here is the confirmation of the sell ticket. I got out of two contracts at $4.60 each when I got in at $3.15 each. I only stayed in the opening market for six minutes. That was long enough.

So if got out and I saw Caterpillar crashing again why wouldn't I buy back into it once again to catch the upside? I will tell you why in a minute but first here is how Caterpillar ended up trading on the day.

Let me answer the question as to why I didn't jump into Caterpillar as it retracked it's early Thursday morning gain. What I didn't tell you is that at 3:13 p.m. on Monday afternoon I jumped-the-gun and bought one Boeing Call. I should have waited until 3:59 p.m.. Here is the ticket.

At the end of the day I found myself down on that position. I just wanted to bail out of Boeing if I ever got my money back. It did. In at $189.00 and out at $2.50. Here is the sell ticket on Tuesday morning. I got out just after I got out of Caterpillar.

That's the main reason I wasn't in the mood to try and play Caterpillar back up again. I was just playing the morning rebound from the previous days oversold closing and I didn't want to hang around very long. * The next day. Nov 30th The D.J.I. charged up in the afternoon. Are you able to day trade Caterpillar on up-days? It's tricky stock to play as in this case Caterpillar was trading down in the morning. It should be mentioned that the fifty moving average has crossed the two hundred day moving average on the upside. That's said to be bullish.

Here is one little trade I did today, a day the markets rallied 737 points in the afternoon.

First, here is how Caterpillar traded on the day.

Here is my little buy and sell. My entry point at 1:06 p.m. was correct. With the stock being off on the day and with other stocks charging up it wasn't the most exciting option position to be entering into.

I was in this position about an hour and twenty-four minutes. I was o.k. with the results. Here is how this series of Calls traded on the day. Not many contracts were being traded on this particular series at this time. I wanted to be out before the end of the day. Tomorrow is a new day. The new day, Dec.1st is here. Here is it's one day chart and here is the one trade in it that I did. I dropped in the first hour of trading as did the D.J.I.

Now look at when I got in and out.

In at 10:12 a.m. which was to soon and out at 12:58. p.m. Given it's lazy trading pattern I will not be holding any positions on it going into Friday's trading session. Friday, the end of the week. One rule is to try and be out of all option positions that are expiring that day by noon unless by chance you have something running hot. Here was my Caterpillar trade for the day. I got lucky on every Caterpillar trade I did this week.

In at 10:20a.m. and out at 12:20p.m.

One might ask as to why I seem to be buying only one and two contracts at a time? It seems like a waste of time. Consider this. Here is how these series of Calls ended up closing out the day.

There is no playbook to follow as to how best to play them. A final note of caution. Buying one week call options on a Monday or Tuesday and catching directional moves is not typically a good strategy unless we are dealing with periods of times like we have now of excess exuberance. Why? The premiums are to expensive.

Comments

Post a Comment