Tesla jumped up $50.00 in one day this week. On Thurday at the close here are the premiums on two series of Tesla Calls and two series of Puts that expire tomorrow (Friday) going into the mornings action. First a look at how the markets closed on Thursday.

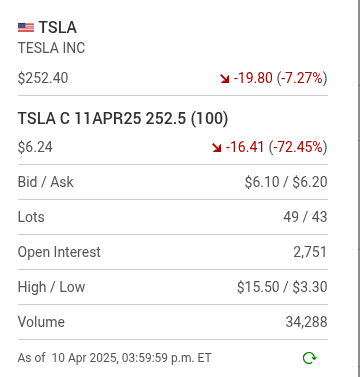

First the Calls. Tesla was down $19.80 on the previous day so a rebound of some sort might be expected.

Now the Puts.

I understand the high open interest numbers on the "out-of-the-money" Calls. They offer leverage if Tesla decides to bounce five or ten dollars on the opening. It often does. Eveen a five dollar bounce on the opening would move the needle upwards on these Calls. Now a look at it's five day chart.

So what happened on Friday morning?

By 9:53 a.m. the 252.50 Calls had jumped up to $8.05. They closed the previous trading session at $6.24. Not much of a gain but enough to illustrate thats what can sometimes happen with one day Calls on Tesla going into the opening. As we will eventually find out that proved to be their high of the day.

Now here they are again at 10:57 a.m.

This takes us now to the Telsa 252.50 Puts which are up only marginally.

Can you see how low they traded on Tesla's small morning bounce. Let's cut to the chase and see how these options were at a 3:00 p.m.

Now the 252.50 Puts.

They did hit a high of $11.40, up from the previous close of $6.25. The 245 Puts expired worthless and the two series of Calls we were watching also expired worthless. The markets at 3:18 p.m. as I write has the (the DJAI) up 652 points. So to recap, Telsa opened stonger on the opening and the $252.50 Puts traded down to $2.93 and then jumped up to a high of $11.40. That's the trade of the day. Here is a chart of how Tesla traded on the day up to $3:40 p.m.

So in at 9:47 a.m. and out at 11:20 a.m. or out at 12:27 p.m. Either way would have netted about the same thing. One has to see the big picture to profit on these price swings. The exercise of Friday option trading (it lasts 7.5 hours with a "get-out deadline" of 3:30 p.m.) is the name of the game for a small number of nimble option traders. It's more difficult to do than it looks. *** Tesla came back in the last thirty minutes to close totally flat.

This kind of action happens every Friday.

Comments