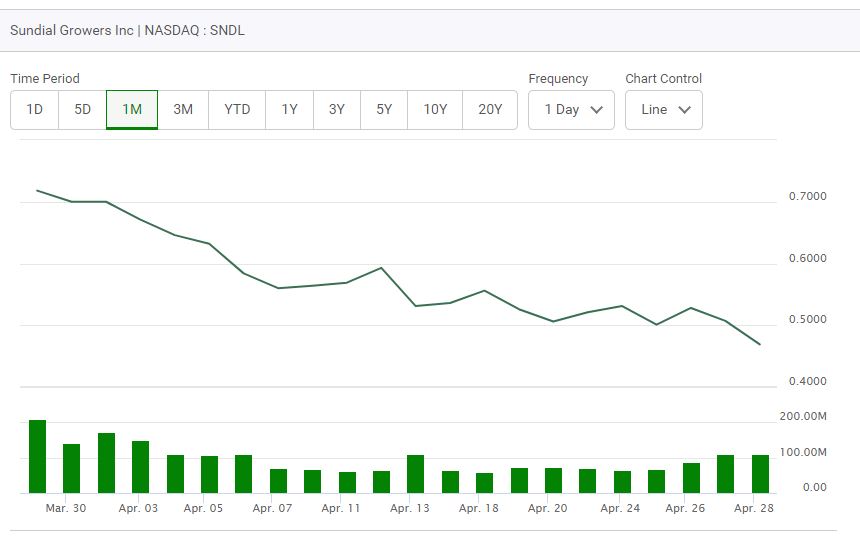

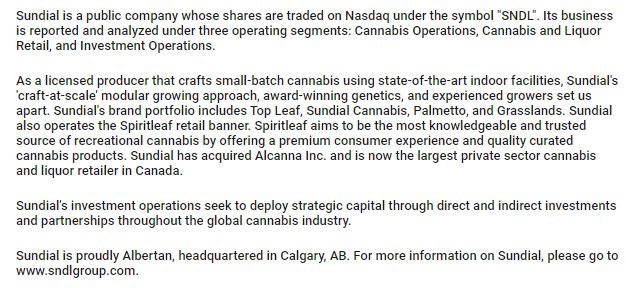

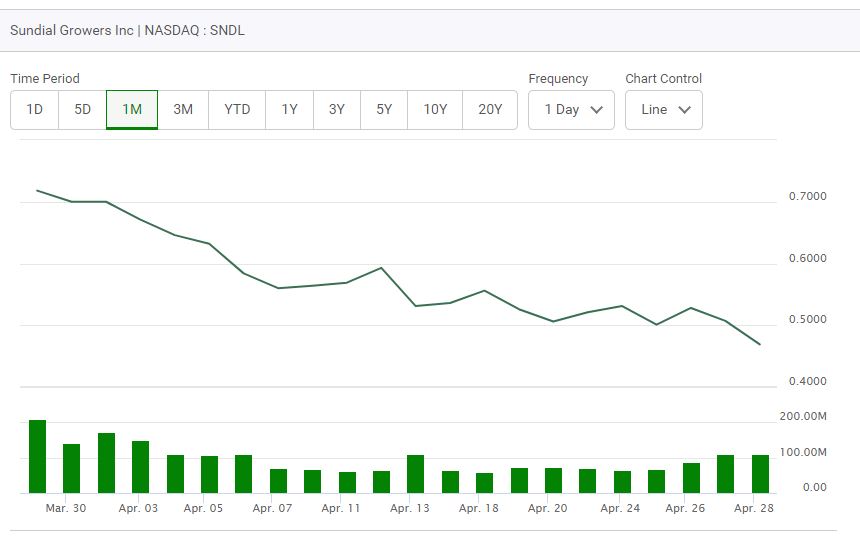

Back in 2019 when this Canadian stock went public (Symbol SNDL) it traded for eight dollars a share. It didn't stay at that price level for very long. Look where it is at now and look at how it continues to slide downwards. Does it look like its going to turn around in the near future? The companies CEO seems to think so given what he says but in 2021 they lost $232 million and their sales were flat. It'a Calgary based company with 580 employees (2021) trying to dance to the changes in the marijuana industry. You see marijuana companies are scrabbling to find new ways to sell their product. Growing it is now not the issue. Being able to find channels of distribution to move the product is now the difficult part. Everyone talks about building "brand recognition" but for a number of reasons including packaging and advertising restrictions it's difficult to differentiate yourself from your competition. Thank goodness for most major growers, in this industry the "buy local" mentality is not prevelent. Many of the smaller companies which are hanging on by the skin of their teeth claim to be "craft growers". Beware, such claims run shallow. There is a glut of weed forcing many of the smaller players out of business. Turf wars in a attempt to become regional retailers are now the norm. Kioks selling the stuff have come to shopping malls. Buyers show little brand loyality as product offerings by individual companies are in an ongoing state of flux. Manitoba will now be allowing mobile trailers too sell weed at outdoor summer music festivals. Marijuana also now grown in every 15th or 20th backyard in Canada and is found drying in sheds in the winter all across our nation. Even seniors are growing it and giving it away. The company Sundial is in this space and it has had a wild ride.

Now read these two stories. The first is about past trading patterns and a second story about a late filing incident.

Now I want to point out an issue they are running into about being listed on the NASDAQ.

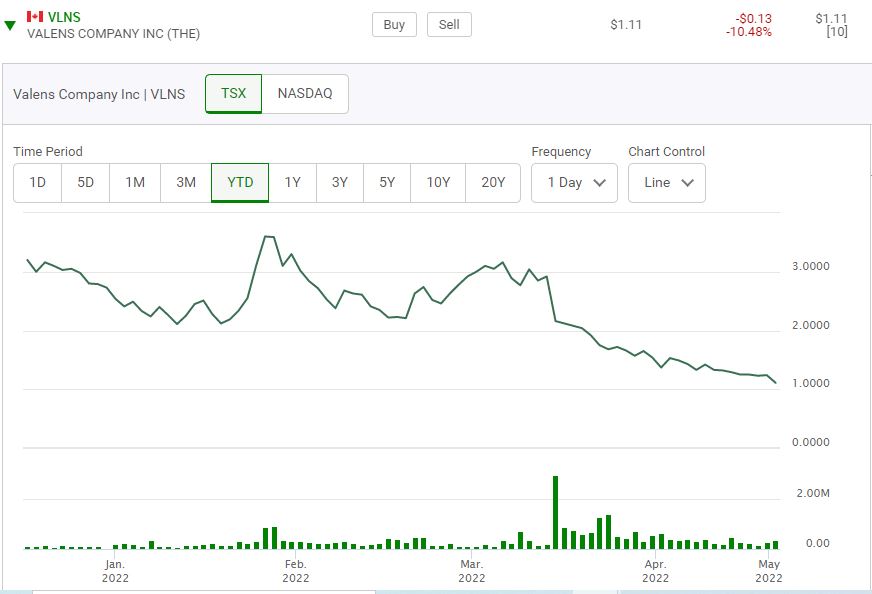

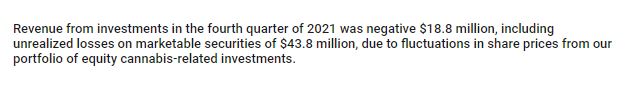

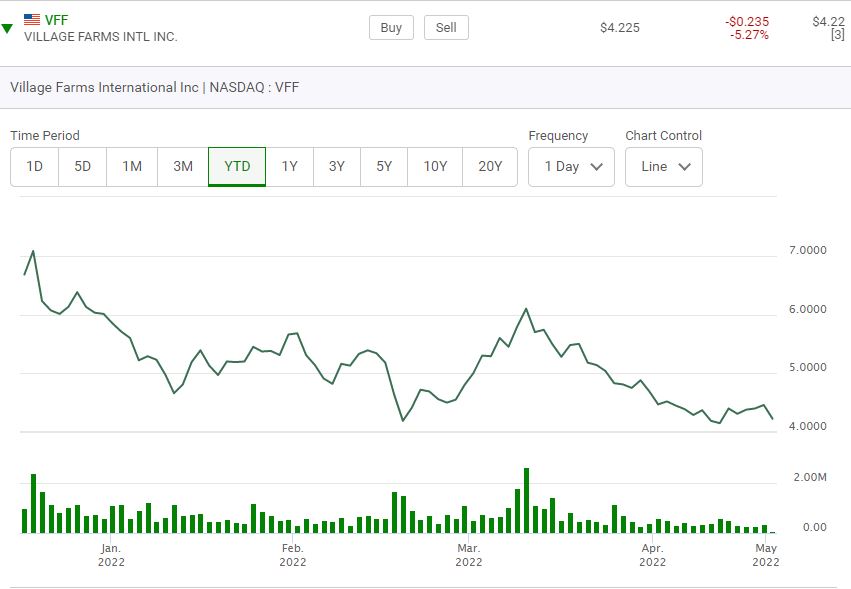

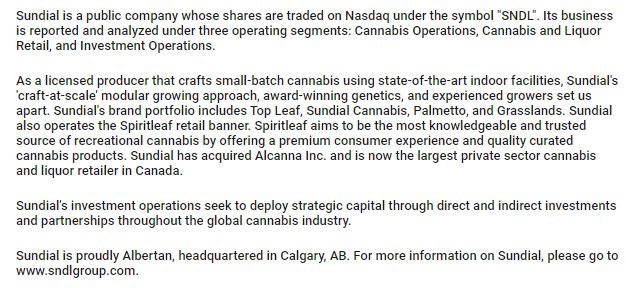

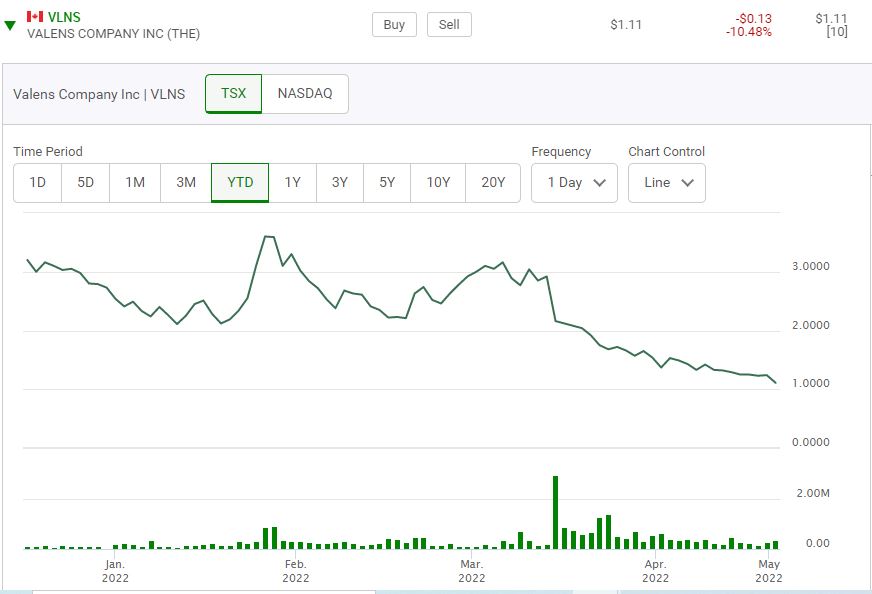

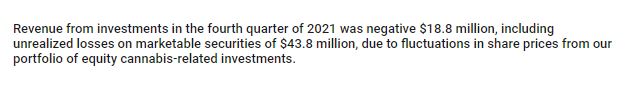

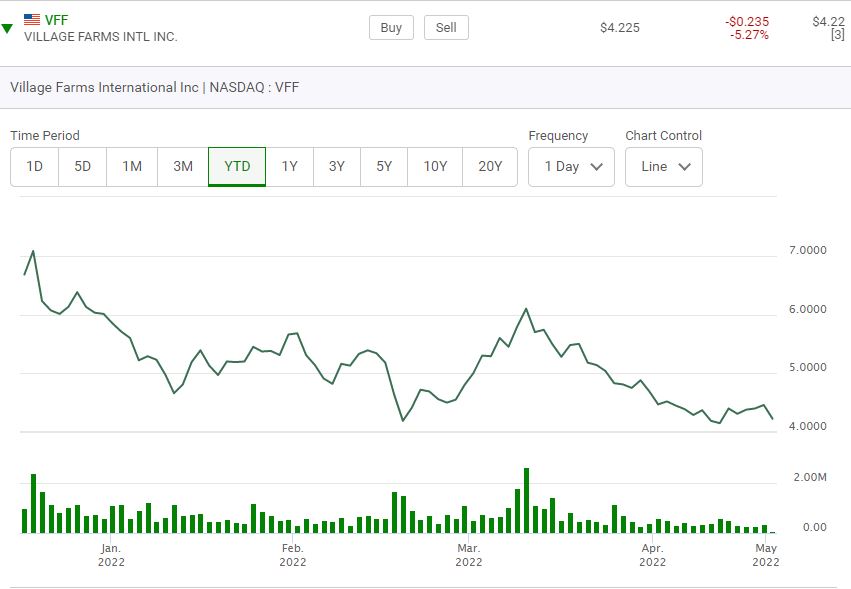

If they do a reverse split a 2 for 1 split it wouldn't be enough. A ten for one reverse slit is more likely however the markets have not being kind to marijuana companies in the recent past doing reverse splits. A twenty-to-one or fifty-to-one reverse split is something that is really needed. They can't afford not to be listed on the Nasdeq and I don't know why they are not more proactive addressing this issue. In 2021 they lost $232 million on sales of 67 million or .12 cents a share. In 2020 they lost 73 million and in 2019 they lost 66 million. These are huge losses. Yet it is reported that they have over one billion dollars of cash in the bank and have an operating arm which invests in other marijanna companies. How is that strategy working out for them? Well it is reported that the operating arm has lent out $400 million and they have mentioned "Village Farms" and "Valient" as two of the companies they are lending money to. Both of these companies are doing poorly "year-to-date". That doesn't augur well.

![]()

Here is how Delta 9 is doing.

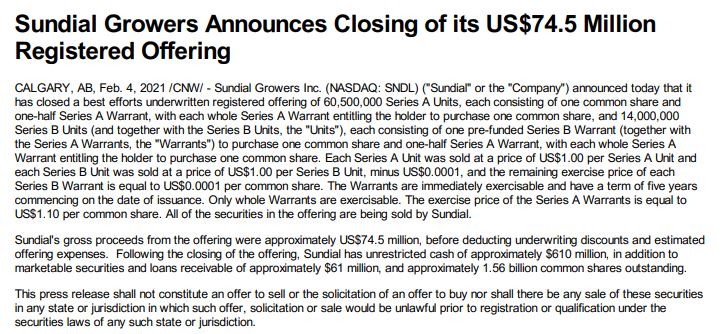

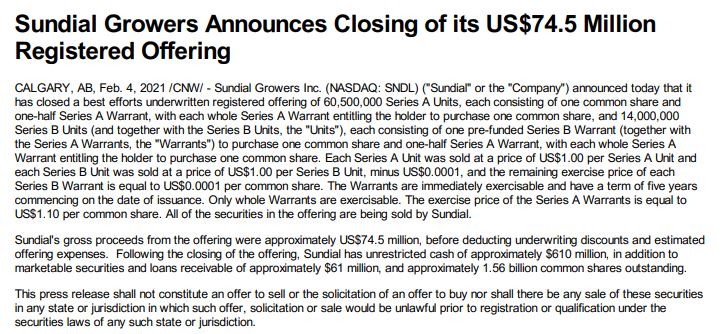

Last year Sundial got into the Alcohol business adding more than 170 liquor stores to their portfolio. They did this by purchasing a company named "Alcanna". More money spent. They are good at doing that. Will this help to put this company on more solid ground or will it keep running around like a chicken with it's head cut off? I note that in 2021 on "Sedar" website (which all investors should use as their bible) there were over 50 entries material developments that Sundial needed to report. That's a high number. After reading all of this your probably wondering how they have managed to have over billion dollars in cash (and no long term debt). Read this. They have a history of going to the markets for more money. Here is one such example.

Why are investors so willing to buy into these new issues? One of the reason is the issuance of warrants and the dream by investors of having this free side bet. In this case it is a five year option to buy more of the stock at $1.10. Finally, not suprisingly options trade on this stock! Talk about scary. I feel that options on stocks in this price range serve no real purpose and I feel our regulators are turning a blind eye on all of this speculative activities. Fifty cent stocks should not be allowed to have options on them. Yet having said this, look at the "open interest numbers" on this January 2023 series of Calls!

A final note. Do your own homework on this one. This company has a history of disappointing their shareholders. * An August 22nd Update. A big fish is buying out a small fish.This may be smart move.

The Sundial storey never seems to end.

Comments