So here are nine examples of what the heading is alluding too. Bad times for the most part to be entering into option positions.

1) Tesla. (these Calls ended up closing the week at $21.15)

2)

3) (These 815 Calls closed the week at $27.74)

4)

5)

6)

7)

9)

8)

Now the closing reading on these Calls at the end of the trading session. $6.20 is down from $8.03 on Tesla and on First Solar the Calls are $3.10 down from $3.35.

Here is what the markets did on the day.

So let's continue on. Now Elli Lilly and Caterpillar. Elli Lilly went from $13.40 to $15.65 and Caterpillar went from $3.95 to bid $3.95 and $4.35. They ended up closing at $18.30). Elli Lilly showing strenght in the second half of the day could be a precursor to something good happening.

Now Biogen. It went from $2.50. down to $1.45.

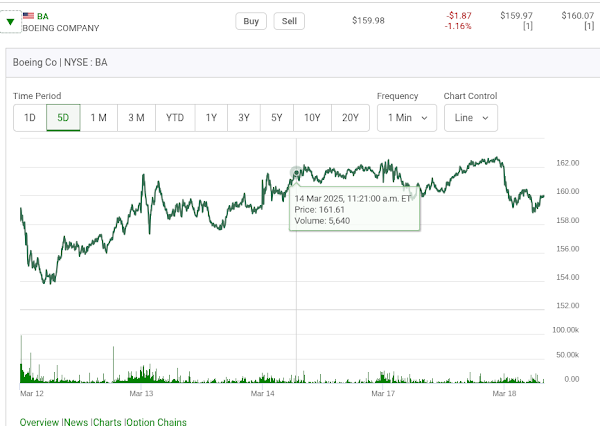

Boeing Calls went from $2.88 to $3.70.

In Biogen there were no further option trades on the day with the bid and ask going up towards the closing bell.

Walmart couldn't do anything as the effect of this tariff situation is all new. When is food going to cost more? It's Calls went from $.88 dollars to $.75 dollars.

Now the last one, Home Depot. $3.80 went to $4.30

So really the markets sold of or went sideways most of the day. I don't like Tuesday at noon for opening positions on options that expire on Friday. At the close or on Wednesday mornings are a better time to be looking for a directional move.

Now what? What happened the next day? First Boeing. Here is the news.

Was there an unusually large number of contracts trading on Boeing on the previos day? Not. Here is how the Calls traded.

Biogen interests me. The stock was down $.45 on the day and only 16 contracts were traded in the series we watched. No one really is finding value in playing the upside. Is this a precursor to bad news? Apparently so. Biogen dropped today.

Then Telsa. Yes you can play Tesla for a bounce on Wednesdays but not so much for a Tuesday bounce. On Monday and early Tuesday you are paying to much for time value.

Eli Lilly had a really big pop after some "Kennedy" news. Nobody really saw this coming.

So my point is that tough markets on Tuesdays can help to give you some clues as to what might happen the following day.

Comments