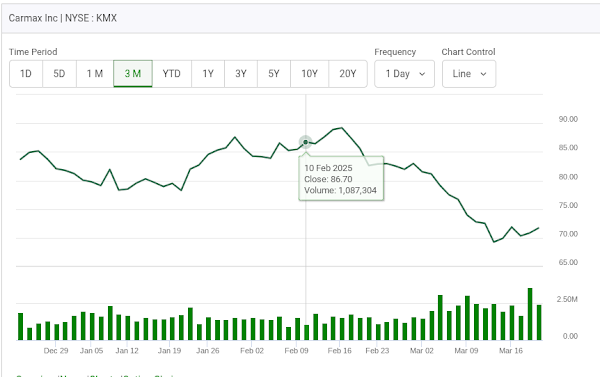

So used car prices might start to cost more money if and when tariffs come into play. That's the latest thesis now under debate. Look at the huge declines in the stock prices of these three used auto selling companies in the last month or so. Totally shocking.

Yet here is the funny thing. All three of these stocks have recently sold off. One reason for this is because car buyers can't afford the payments on the new cars they recently purchased at the low financing dealer rates. These vehicles are being dumped. If new cars are suddenly going to cost more because of tariffs then wouldn't these used car organizations fair better in selling the inventory they just bought at low prices? The cycles that the used car industry goes through are often frought with danger. Now this. A five day chart of "Carmax".

Now this, a look at the one day Call options (that expire tomorrow) on "Carmax".

What strikes you about them? What strikes me is that the volume of trading is only one contract. One piece of this puzzle missing is the wide spread "bid and ask" price posted for most of the day. The spread was something like seventy five cents meaning they were making this series of options difficult to buy into or sell out of. Now as a point of reference I want to show you the next week out Call options. Guess what? I can't. They don't exist. I was watching them. The way these series of options are structured the next series of seventy Calls are now one month out. Here they are. They are really not as expensive as they look because they are already partially "in-the-money".

Now this, a look at two series of the Puts which expire tomorrow. You will be suprised when you see this! What do you see?

I see a large interest in very low priced "out-of-the-money" Puts. Let's watch this action tomorrow. The stock has dipped below seventy dollars a share on three out of the four last trading sessions. How will these purposely "late-to-the-party" option traders do? Now an early morning look at this situation.

The Puts did hit $55 but if you want out now you would most likely get $15 .The option makers at this point in time are not going to be kind to you. An "at-market" ticket to sell at around the time it was trading at $55 would have gotten you much more than this $.15 price. Here is what the markets are doing.

It's now 10:02 a.m.

Now this, at 10:31 a.m. not much has changed except the stock is rebounding. I would just get out.

Now this is interesting. Look at how they are making the upside impossible to play. Look at how far apart the "bid" and "ask" are. It's not liquid enough.

Maybe now would be a good time to look at the one month out Calls.

Now this at 11:45 a.m..

Now this.

But wait. The bid and ask on the Calls are now looking more reasonable. Could the stock gain a dollar or so if the D.J.I.A starts to rebound? But no. It's all getting kind of crazy. Just walk away from everything and find something else that looks better. If you like the stock for a rebound the next months Calls are now the way to go.

The stock closed at $71.32. Here is it's five day chart. In at 10 cents on the close and out in the first few minutes on the opening. That was five minute play.

** Avis, one of it's competitors had a better day. It's options are also lightly traded.

All three of these companies could be a study in themselves.

Comments