If we look at the stock Carvana from a five or ten day persective that's not really enough time to get a full understanding of why the stock is trading the way it is. First a look at it's one month chart.

Now a five day chart. On average it's up about five dollars a day.

It kind of makes you wonder when you can start to play the downside. Now Netflix, a five day chart. It's the same thing, it's up over $75.00 in five trading sessions.

We can't forget Tesla, it's up fifty dollars in five days.

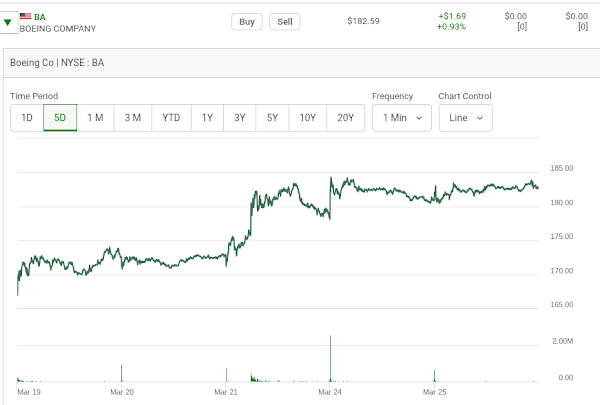

Boeing also got sucked into the upward draft as it had a few bits of good news like a government contract for new planes. This stock has also jumped in price.

Had any option player tried to fight any of these stocks using Puts as a trading vehicle in the last five days they would have quite simply gotten smashed. Is there any reasons to now think its time to play the next three days of market trading looking for some downside action? Wednesdays are afterall days of market reversals? Here are the prices of slightly "out-of-the money" Puts on these four stocks which expire this Friday going into the opening bell on Wednesday morning. I have no clue what is going to happen. Let's watch an see what happens.

............

......................

..............

It should be interesting to see what happens. Now this, a look at the first three stocks in the first twenty-three minutes of trading. The D.J.I.A is up but not these first three stocks.

These options have jumped 70% in about twenty-three minutes. ...........................

These options have jumped about 53% in twenty-three minutes......................

These options have jumped about 51% in twenty-three minutes. The Boeing options have not really moved.

. Wednesday mornings are sometimes like this. This is the first twenty two minute time period in the last five days of trading that any of these Puts options have increased in value. In option trading timing is everything. ** the closing readings.

With things like this happening more option chatter like this needed.

Comments