Read my Oct 27th 2023 blog partially entitled "Why Solar Stocks Are Falling". Now the "year-to-date" chart of First Solar.

What a drop in one month! This stock kind of fell in sympathy with the recent decline in prices of the "Magnificent Seven". Yet it is said AI could help the solar industry.

Then there is the issue of NEM 3.0. If your going to play solar stocks you should know what this is.

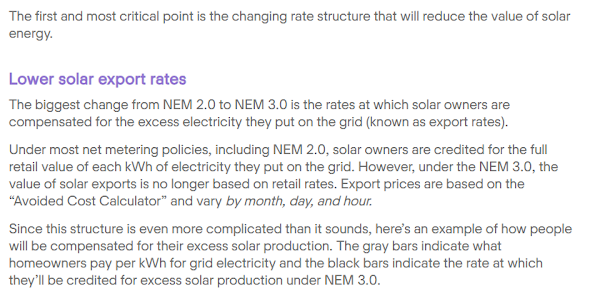

Without going into to many details and without showing the grey bars they are talking about the laws have changed about how much money you get for selling power back the grid. The government in California has cut back on the payouts associated with selling electricity to the grid in the hopes that homeowners will spend more money on in-home energy storage units. Google NEM 3.0 and then youtube videos which will explain the details of these new regulations. Yet California makes up only part of their markets. It's an industry in constant change and this stock bounces up and down ten and twenty and fifty dollars often making for exciting option trades. It's kind of like trying to trade Telsa. Sentiment can change on a dime. Now here is First Solar's five day chart.

At the same time the stock released it's second quarter profit report. It was good but apparently not good enough.The stock dropped like ten dollars yesterday (July 30th) on the release of this news. Here is yesterday's chart.

Good earnings, a new factory and evolving business models. What a way to sell the sizzle. What's the new factory all about?

Why the big drop on the release of this quarterly report? It should have rallied. Welcome to the world of option trading on First Solar. It's a tough one to play options on with so many moving parts. Now look at today's action. The stock was down on the previous day on the release of it's strong earnings report. This morning it shot to the moon.

Notice only 461 contracts traded on this stock today and how at the end of the day the open interest number was only 139. Now watch it jump the very next morning on August 1st. Back up to $16.00 again.

Now the August 210 Calls again. Look at how high they traded on a morning bounce.

That's the 10:11a.m. Now the 4:00 p.m. numbers.

These Call options are "in-the-money" and have held there value over the last two days. That's suprising because the D.J.I.A. was down over 700 points at one point today.

To be continued.

Comments