If you have winnings from a previous trade sometimes you value that money differently. It's difficult to explain why but there are scholars out there who have written books on this very topic. It's like play money or free money that you can now use to make the wildest option trades you can think of. It's money you feel you can risk. It's like being a kid in a candy store with money in your pocket. Everything looks good.There are two stocks that I sometimes follow, Dominos Pizza and John Deere. Both have options available to trade on them however the Call and Put options on the first one, Dominos are near impossible to trade. Why? Well on a Friday morning with options expiring that day on it, how do you predict which direction the stock on the world's largest pizza company is going to go? The answer is you can't. The company is painfully aware that one news release about the price of cheese going up or problems with their ordering apps could send their stock into a dizzy. As a retail investor without access to the inner intricacies of what is going on behind the scene makes these options near impossible to play. In contrast, I find John Deere Calls and Puts with one day to go on strong or weak opening markets so much more interesting to play. It seems that there isn't a day that goes by where some obsure analyst with some even more obsure investment company is upgrading or downgrading this stock or there are other news releases on countless issues affecting Deeres day-to-day operations. Their development of driverless tractors for example, often makes for news releases. For many different reasons the John Deere's operationing realities constantly seems to be in the spotlight. Look at Deere's five day chart followed by it's one day chart on Friday morning. Can you see the stock shooting up towards the sky in the early morning trading? So too were the market indexes. As I was watching it my thoughts were "what goes up must come down". Are we near the top? At 9:42 a.m. Deere was trading at $389.48.

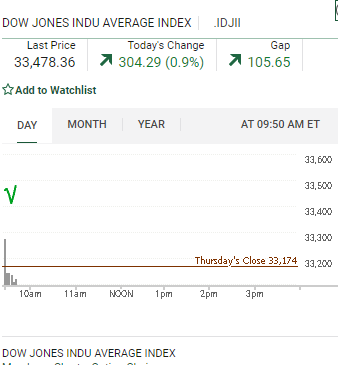

Now look at the one day chart and look at where Deere was trading at 9:42 a.m.. Would you be thinking of purchasing a put on it right at that moment? I was. I did. The stock was shooting up up how high could it go? Sometimes going against a strong short term upward movement is the best way to go. That plus the D.J.I.at 9:50 a.m. was up over 300 points. My purchase ticket to buy in was at a time in the morning when the morning volume of Puts traded on this series was only two contracts. Few were bold enough, or stupid enough to be buying in. I knew that and didn't much care. Traders were sleeping.

The option was set to expire that day and I was buying a 387.50 Put when the stock was trading at $387.87. The stock would have to go down by about three dollars just to get my money back.

At 9:53 another eleven minutes later the stock was up about three dollars to 391.00 and at 9:59 a.m., it was up another eight dollars to $399.70! My position suddenly became like twelve dollars "out-of-the-money". Talk about bad timing. What the heck was going on? Look at this "bid and ask". The option makers where having a difficult time trying to make their markets and the readings on some of their bids and asks got stupid. Further complicating things was the lack of trading volume in this series of options. I wanted to purchase a second contract and I became a little fly on their back constantly bumping up my bid by ten or twenty cents over the then current bid. In doing so I helped to make the system tighten it's bids and asks. I did this about every fifteen seconds for about a minute and sometimes there was like a twelve second delay in posting my slightly higher bid. Here is one printout which helps to better illustrate the utter chaos in it's pricings.

At 9:59 a.m. some six minutes after the above printout shows a then current "bid and ask" I purchased another Put, this time at $1.71. It's difficult to imagine the guessing game I had to play to get a fill at the price I wanted. I was taking a huge risk as it was a thinly traded market. If the stock was to start trading sideways an exit strategy would be next to impossible with the bid and ask being so far apart. My total cost in for two contracts was now like $460.00 plus commissions. Talk about being out on a limb. .

The good news is that the stock started to drop quickly and I saw the bid and ask in this panic to jump to bid $3.00 ask $5.00! As quick as I could I placed a sell ticket in at $4.00 with no second thoughts. A spread that large, that quickly, showed a fear factor that could go away as quickly as it popped up. I got a fill instantly and my fill price ended up being the highest selling price of the day! Here is my sell ticket and if you look at the time on the ticket and compare it to the stock's price at that time on the above chart you can see I nailed my timing perfectly.

I was in and out of these two positions in thirty-nine minutes. Had I not sold out then I would have ended up in a painfull position. Here is how this series of Puts ended up closing out the day. Note only 104 contracts traded on the day. This goes to show that not many traders are willing play the downside on Deere with one day to go. In at $460.00 and out at $800.00. I have to confess it is a trade almost to rich for my blood.

**** here now is a chart of Domino's yesterday. In the first 47 minutes it sold off $7.33. There was money to be made there also. Their Call and Put options are also thinly traded. *** Are one day options a wise investment? they are a study in themselves. Traders that trade them know that 80% of the time all the action happens in the first few hours of market trading. More about that another time.

Comments