There was not to much of a suprise but maybe a floor price has been reached. The stock is now down considerably and vehicle orders are now expected to tick up. A new more affordable EV is being launched this year that will cost less. Investors were nervous going into this report and the stock as of late has being in a precipitous slide downwards. It's going to take a day or two to process this fresh news. The EV industry is taking it on the chin as of late. Part of the good news is that Lucid is not using the word "burn rates" They also seem to have access to more cash going forward if needed. Both Lucid and Rivian are now appearing to be more fiscally responsible. Yet we now have to wait another full quarter to confirm such a suspicion.

Shown above is it's five day chart and below is it's one year chart.

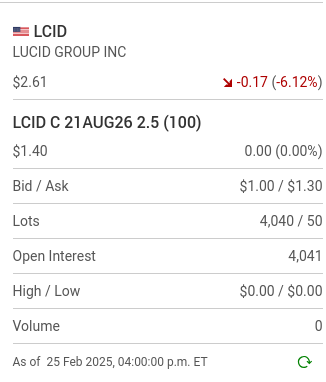

In previous blogs I have talked about three, four and five dollar stock's and options on them. They can sometimes suprise. Is this one of those moments where Calls thirty days out are the correct one's to be playing? Maybe thirty days is not time enough. Look at these two different series of Calls.

One contract costs $39.00 dollars and one cost $20.00. Buy as many as you want or buy the options six months out.

In my prevous blog I talked about Rivian and we looked at it's situation. The just released forecast of declining sales is now sinking in and the stock was off again today. Lucid's news today has a different takeaway. It's sales are expected to go up. That's exactly what investors need to hear. On a differing, note Walmart popped again today. It took a few days to shrug off a disappointing earnings report. People still have to eat.

One final caveat. Don't buy any of these options "at market". The spreads are to far apart. Read my last blog which mentions the "short interest" on both of these stocks. Playing these options is not a walk in the park with so many variables in play. Remember for example, only a few days ago the D.J.I.A. was down over 700 points. Let's check in on these options a few weeks down the road. A Friday Feb 27th update. A touch of bad news that might take a few days to absorb. That's ok. Here is the news.

A six year tenure could be viewed as time for a change. The timing of this change in conjunction with the news of higher production numbers to come is a good thing. *** A March 18th update.

Now two snippents from a Feb 15th blog.

Comments